- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

China Urea Price Index:

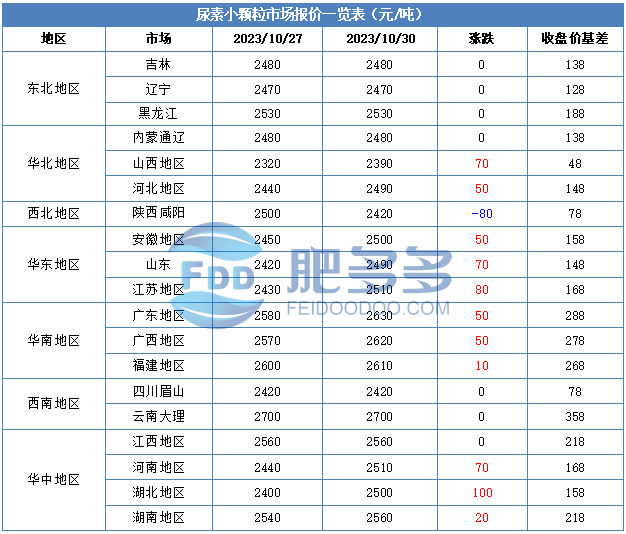

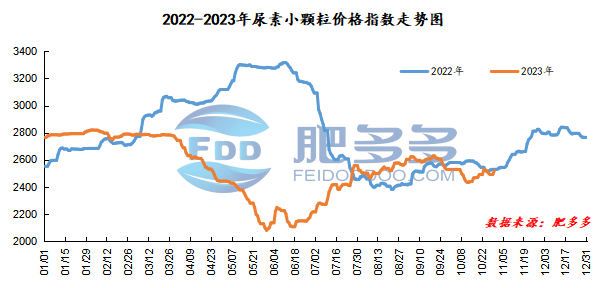

According to Feiduo data, the urea small pellet price index on October 30 was 2,520.59, up 28.64 from last Friday, up 1.15% month-on-month, and down 0.34% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2296, the highest price is 2375, the lowest price is 2278, the settlement price is 2333, and the closing price is 2342. The closing price is up 122 compared with the settlement price of the previous trading day, up 5.50% month-on-month. The daily fluctuation range is 2278-2375, and the basis of the 01 contract in Shandong is 148; the 01 contract has increased its position by 34705 lots today, and so far, it has held 371150 lots.

Spot market analysis:

Today, China's urea market prices have risen again, and mainstream regional prices have continued to rise, with the increase range ranging from 10 to 100 yuan/ton. The current market atmosphere is improving, and there are appropriate follow-up actions. Coupled with the positive international news, the company's factory quotations have been increased.

Specifically, prices in Northeast China have stabilized at 2,460 - 2,550 yuan/ton. Prices in North China rose to 2,390 - 2,500 yuan/ton. Prices in Northwest China fell to 2,420 - 2,430 yuan/ton. Prices in Southwest China have stabilized at 2,420 - 2,800 yuan/ton. Prices in East China rose to 2,480 - 2,550 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,500 - 2,620 yuan/ton, while the price of large particles fell to 2,530 - 2,610 yuan/ton. Prices in South China rose to 2,590 - 2,630 yuan/ton.

Market outlook forecast:

On the supply side, Nissan is still operating strongly and the operating rate remains high. This week, Shandong Runyin has plans to stop production, and some companies also have parking plans next month. Production is expected to drop slightly. In terms of factories, the pressure on manufacturers to collect orders has eased slightly. Affected by changes in export news, most factories have changed their mentality. Currently, they are more optimistic about prices. Coupled with the support of waiting, factory prices have been raised. In terms of demand, agricultural demand is still in a state of winter storage. Affected by its long cycle, agricultural demand procurement mentality is more wait-and-see; in terms of industrial demand, the Northeast compound fertilizer market has started one after another, but the overall compound fertilizer market operating rate continues to remain low. Raw material prices are high, and compound fertilizer factories are in a wait-and-see state in many places. Overseas, Egypt announced on the 29th that it would weaken urea production due to natural gas shortages. Falling supply in Egypt is expected to raise international market prices. Higher internal and external price differences raise China's urea valuation.

On the whole, the urea market is currently waiting for exports to benefit the entire market. The result of the participation in the stamp will become a key factor in the direction of China's urea prices. Judging from the current export news, it is expected that there will still be room for adjustment in the urea market in the short term.