- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: October 23rd V2401 contract opening price: 5987, highest price: 6024, lowest price: 5947, position: 925678, settlement price: 5985, yesterday settlement: 5980, up: 5, daily trading volume: 1129743 lots, precipitated capital: 3.896 billion, capital inflow: 26.31 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.20 |

Price 10.23 |

Rise and fall |

Remarks |

|

North China |

5730-5800 |

5730-5800 |

0/0 |

Send to cash remittance |

|

East China |

5850-5920 |

5820-5930 |

-30/10 |

Cash out of the warehouse |

|

South China |

5930-5980 |

5900-5990 |

-30/10 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5800-5830 |

5800-5830 |

0/0 |

Send to cash remittance |

|

Southwest |

5600-5700 |

5600-5700 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, some areas rose slightly. Compared with the valuation, the low-end prices in North China are stable, the low-end prices in East China are down 30 yuan / ton, the high-end prices are up 10 yuan / ton, the low-end prices in South China are down 30 yuan / ton, and the high-end prices are up 10 yuan / ton. Prices in Northeast China, Central China and Southwest China are stable. The ex-factory prices of upstream PVC production enterprises basically remained stable, without obvious adjustment, coinciding with the wait-and-see mentality of a generation of merchants on Monday, and few orders were signed. Futures slightly strong operation, but the overall price adjustment of the spot market is not obvious, multi-range narrow arrangement, some areas merchants slightly increase the price. Spot market point price offer coexists, the basis adjustment is not large, including East China base offer 01 contract-(70-100-150), South China 01 contract-(0-50-80), North 01 contract-(400-520), Southwest 01 contract-(250). On the whole, the purchasing enthusiasm of the downstream is not high, the wait-and-see intention is strong and the trading atmosphere is general, and the spot market is slightly light at the beginning of the week.

From a futures point of view: & the nbsp; PVC2401 contract opened high and opened low on Friday night, with a certain downward trend but not a small decline and then repaired upwards. Early trading began after the price to maintain a narrow range of shocks, intraday rose to break the 6 prefix, in the afternoon near the 6 prefix narrow finishing. 2401 contracts range from 5947 to 6024 throughout the day, with a spread of 77. 01. The contract increased its position by 2412 hands, and so far it holds 925678 hands. The 2405 contract closed at 6110, with 106767 positions.

PVC Future Forecast:

Futures: & the nbsp; PVC2401 contract price is slightly stronger in intraday trading, and the daytime futures price is basically located in the narrow range of the 6-word prefix, but the overall position does not change much. The trading statistics of the disk are still mainly empty, of which 25.1% are open compared with 22.3% more. The technical level shows that the meaning of the three tracks of the Bollinger belt (13,13,2) is obvious, the KD line at the daily level shows a golden fork trend, the MDCD dead fork trend shrinks, and the fluctuation of the futures price rises above the middle rail position. At present, the guidance from PVC fundamentals and macro policy ports is relatively small, from the perspective of chlor-alkali balance, caustic soda futures have declined significantly in the near future. On the whole, the operation of futures prices in the short term may still be dominated by medium-track winding, and continue to observe the performance of the 6000 mark.

Spot aspect: early week spot market operation relative interval arrangement, first of all, futures slightly strong operation, some areas of a price offer merchants still have a boost, but the range of adjustment is relatively narrow, upstream factories on the current market feedback slightly wait-and-see, more stable price digestion inventory. From an emotional point of view, the current adjustment is not enough to drive the spot market to run well, in addition, the overall high inventory constraints, and the current time node gradually into the off-season, downstream products enterprises are increasingly insufficient to follow up, so even if there are some rising trends in the two cities, the range is expected to be relatively narrow. However, for the current downside, it is expected that it will be difficult to have a relatively deep decline in the short term without further falling below the low of 5858 since the high has fallen sharply. Therefore, in the short term, the spot market will still appear as a small arrangement, and the price will be adjusted slightly.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.20 |

Price 10.23 |

Rate of change |

|

V2401 collection |

5987 |

6012 |

25 |

|

|

Average spot price in East China |

5885 |

5875 |

-10 |

|

|

Average spot price in South China |

5955 |

5945 |

-10 |

|

|

PVC2401 basis difference |

-102 |

-137 |

-35 |

|

|

V2405 collection |

6088 |

6110 |

22 |

|

|

V2401-2405 closed |

-101 |

-98 |

3 |

|

|

PP2401 collection |

7441 |

7443 |

2 |

|

|

Plastic L2401 collection |

7954 |

7989 |

35 |

|

|

V--PP basis difference |

-1454 |

-1431 |

23 |

|

|

Vmure-L basis difference of plastics |

-1967 |

-1977 |

-10 |

|

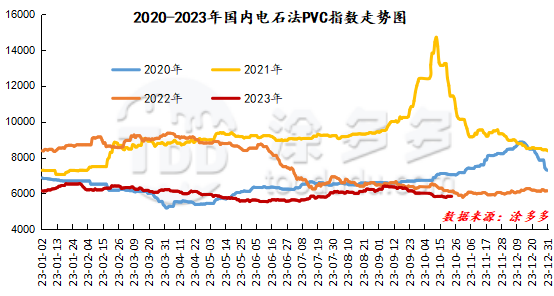

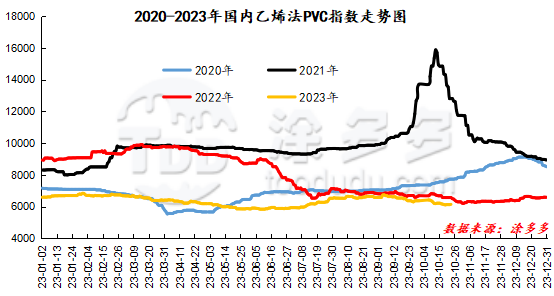

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 5.19, or 0.089%, to 5835.54 on October 23. The ethylene PVC spot index was 6138.88, up 15.96, with a range of 0.261%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 303.34.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.20 warehouse orders |

10.23 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

351 |

77 |

|

|

Zhenjiang Middle and far Sea |

274 |

351 |

77 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,269 |

9,269 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

7 |

7 |

0 |

|

PVC subtotal |

|

29,999 |

30,076 |

77 |

|

Total |

|

29,999 |

30,076 |

77 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.