- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

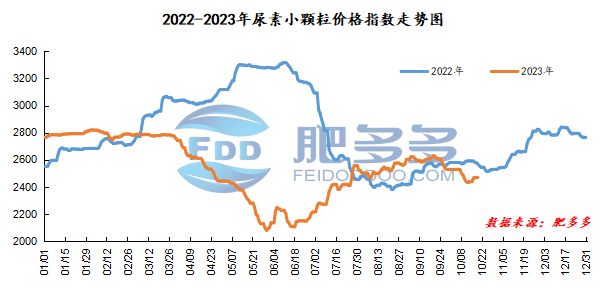

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 19 was 2,475.59, up 6.36 from yesterday, up 0.26% month-on-month, and down 3.59% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2165, the highest price is 2306, the lowest price is 2165, the settlement price is 2255, and the closing price is 2280. The closing price is 136 compared with the settlement price of the previous trading day, and the month-on-month increase is 6.34%. The daily fluctuation range is 2165-2306, and the spread is 141; the 01 contract has increased its position by 21993 lots today, and so far, it has held 375740 lots.

Spot market analysis:

Today, China's urea market prices continue to increase and consolidate operations. Currently, the market prices are supported by the upcoming bid opening and the upcoming bid opening of stamps. The overall atmosphere is good. Some companies restrict the acquisition of orders. Futures prices have increased significantly, and spot prices have also followed suit.

Specifically, prices in Northeast China have stabilized at 2,440 - 2,490 yuan/ton. Prices in North China have been raised to 2,380 - 2,490 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China are stable at 2,380 - 2,800 yuan/ton. Prices in East China have been raised to 2,370 - 2,440 yuan/ton. The price of small and medium-sized particles in Central China has been raised to 2,390 - 2,620 yuan/ton, and the price of large particles has stabilized at 2,530 - 2,560 yuan/ton. Prices in South China have been raised to 2,540 - 2,600 yuan/ton.

Market outlook forecast:

In terms of supply, affected by factors such as environmental protection and production restrictions in Shanxi factories, the supply of large granules in the urea market is currently slightly tight. On the manufacturer's side, there is still support for the company's orders. Coupled with the current low inventory, the two jointly maintain a firm price. Among them, the transaction in the large particle market is relatively good. The factory continues to increase its ex-factory quotation. The overall price of small particles is stable, and the price is not significant. Change. In terms of demand, there are still winter reserves in the Northeast market. However, due to the current high prices and high supply, the overall purchasing sentiment is more cautious. With the advent of label printing, downstream traders are more wait-and-see.

On the whole, transactions in the urea market are currently flat, and we will wait for tomorrow's bid opening. It is expected that the urea market price will remain consolidated and running in a short period of time. Specific attention needs to be paid to the procurement situation in the Northeast market and the bid opening situation of stamp opening.