- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: October 17 V2401 contract opening price: 5980, highest price: 5990, lowest price: 5895, position: 979035, settlement price: 5937, yesterday settlement: 5968, down: 31, daily trading volume: 938567 lots, precipitated capital: 4.056 billion, capital inflow: 38.59 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.16 |

Price 10.17 |

Rise and fall |

Remarks |

|

North China |

5750-5800 |

5710-5750 |

-40/-50 |

Send to cash remittance |

|

East China |

5830-5920 |

5790-5870 |

-40/-50 |

Cash out of the warehouse |

|

South China |

5900-5970 |

5850-5950 |

-50/-20 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5750-5900 |

0/-50 |

Send to cash remittance |

|

Central China |

5830-5850 |

5830-5850 |

0/0 |

Send to cash remittance |

|

Southwest |

5650-5850 |

5600-5800 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price adjustment is frequent, today's price down slightly. Compared with the valuation, it fell by 40-50 yuan / ton in North China, 40-50 yuan / ton in East China, 20-50 yuan / ton in South China, 50 yuan / ton in Northeast China, stable in Central China and 50 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises still remain stable, with individual enterprises reducing by 50 yuan / ton, but there are not many contracts signed in the first generation, and inventory digestion in the factory area is relatively slow. Futures prices are weak downward, the price offers of traders in various regions have been reduced compared with yesterday, and higher offers are more difficult to close transactions, point-price sources have price advantages, and the bases of various regions have been adjusted slightly. Among them, East China base offer 01 contract-(50-100-130), South China 01 contract-(0-30-90), North 01 contract-(400-520), Southwest 01 contract-(250). On the whole, the purchasing enthusiasm of the downstream is not high, the terminal rigid demand for replenishment is dominated by low-price orders, and the trading atmosphere in the spot market is general.

Futures point of view: PVC2401 contract night market opened high and low, there was a significant downward trend. After the start of morning trading, the price fell below the 5900 mark, followed by a low and narrow concussion. The trend of afternoon prices still continues to be mainly arranged in a narrow range. 2401 contracts range from 5895 to 5990 throughout the day, with a spread of 95. 01. The contract increased its position by 18245 hands, and so far it holds 979035 hands. The 2405 contract closed at 6028, with 112132 positions.

PVC Future Forecast:

Futures: PVC2401 contract futures prices did not continue to break upward on the basis of yesterday, but there was a situation of high opening and weak opening, and the market increased positions and fell short obviously. In terms of trading, the short opening was 25.4% compared with 22.6% more. The total position is more than 979000 hands approaching one million positions. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) narrows, the KD line of the daily line level once again shows the intersection of dead forks, the trend of MDCD dead forks still exists, and the technical level is not good. At present, the overall upward guidance of the market is insufficient, close at noon, the main Chinese futures contracts rise and fall differently, and PVC main contract prices have been in the situation of low horizontal collation after the festival, futures prices are expected to continue this trend in the short term, observing the performance of 5900 and the first two points of 6.

Spot aspect: low horizontal market situation also leads to light transactions in the spot market. First of all, downstream products enterprises are not active in taking goods, rigid demand is mainly low-price order replenishment, in addition, under the current trend of narrow market consolidation, traders also lack incentives to take goods. Generally speaking, the operation of the spot market is relatively anxious, both upstream production enterprises and middlemen have greater difficulties in digesting supply, but there are hedging policies after the rise of the stock price to ease the pressure on some of the spot market. PVC fundamentals, calcium carbide prices have declined, cost support weakened. In the outer disk, the price of international crude oil futures market fell more than $1, as the market expected that the United States and Venezuela may soon reach an agreement that the United States will relax restrictions on Venezuelan crude oil exports. At the same time, traders say the Israeli-Palestinian conflict does not seem to threaten crude oil supplies in the short term. On the whole, in the short term, the spot market of PVC will continue to collate mainly at a low level.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.16 |

Price 10.17 |

Rate of change |

|

V2401 collection |

5973 |

5918 |

-55 |

|

|

Average spot price in East China |

5875 |

5830 |

-45 |

|

|

Average spot price in South China |

5935 |

5900 |

-35 |

|

|

PVC2401 basis difference |

-98 |

-88 |

10 |

|

|

V2405 collection |

6079 |

6028 |

-51 |

|

|

V2401-2405 closed |

-106 |

-110 |

-4 |

|

|

PP2401 collection |

7517 |

7452 |

-65 |

|

|

Plastic L2401 collection |

8055 |

7998 |

-57 |

|

|

V--PP basis difference |

-1544 |

-1534 |

10 |

|

|

Vmure-L basis difference of plastics |

-2082 |

-2080 |

2 |

|

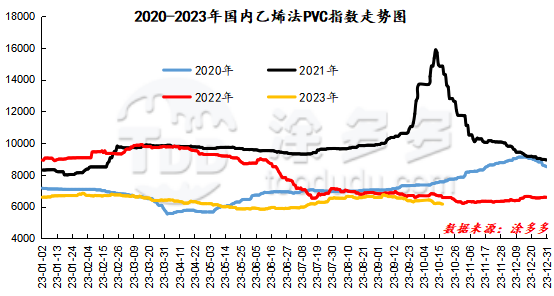

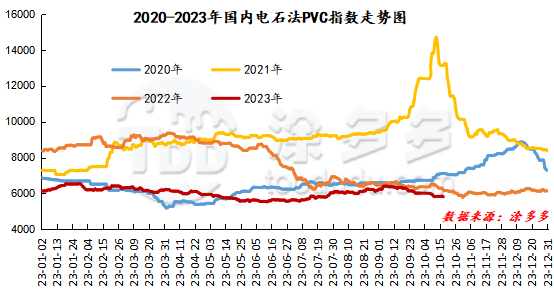

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC was 5814.02, down 36.48, or 0.624%. The ethylene method PVC spot index was 6153.65, down 20.56, with a range of 0.333%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 339.63.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.16 warehouse orders |

10.17 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,292 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,409 |

9,209 |

-200 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

30,081 |

29,881 |

-200 |

|

Total |

|

30,081 |

29,881 |

-200 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.