- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: October 16 V2401 contract opening price: 5980, highest price: 5996, lowest price: 5934, position: 960790, settlement price: 5968, yesterday settlement: 5952, up: 16, daily trading volume: 960790 lots, precipitated capital: 4.017 billion, capital inflow: 67.56 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.13 |

Price 10.16 |

Rise and fall |

Remarks |

|

North China |

5730-5800 |

5750-5800 |

20/0 |

Send to cash remittance |

|

East China |

5800-5910 |

5830-5920 |

30/10 |

Cash out of the warehouse |

|

South China |

5870-5950 |

5900-5970 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5750-5950 |

0/0 |

Send to cash remittance |

|

Central China |

5830-5850 |

5830-5850 |

0/0 |

Send to cash remittance |

|

Southwest |

5650-5850 |

5650-5850 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly, but trading slightly general. Compared with the valuation, it rose 20 yuan / ton in North China, 10-30 yuan / ton in East China, 20-30 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. The ex-factory prices of upstream PVC production enterprises mostly remain stable, which coincides with the heavy wait-and-see mentality of production enterprises on Monday, and there are not many contracts signed in the first generation. The futures price is slightly stronger, and some traders in the spot market in various regions have risen slightly, but it is difficult to close a deal when the price is too high, and the basis offer is slightly weaker than last Friday, including East China basis offer 01 contract-(70-100-150), South China 01 contract-(0-70), North 01 contract-(380-400-490), Southwest 01 contract-(250). Compared with the point price supply part of the price, there is still a price advantage, but the downstream purchasing enthusiasm is not high, low-price orders are mainly rigid demand replenishment, on the whole, the trading atmosphere in the spot market on Monday is weak.

From a futures point of view: & the nbsp; PVC2401 contract opened high in Friday night trading, but then the price began to weaken when the rally was not strong enough. After the start of morning trading on Monday, the futures price rose to its highest point of 5996 and nearly broke through the prefix, while the afternoon price was mainly arranged in a relatively high and narrow range. 2401 contracts range from 5934 to 5996 throughout the day, with a price spread of 62. 01 contracts with an increase of 13303 positions and 960790 positions so far. The 2405 contract closed at 6079, with 108031 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices jumped high last Friday night, from this trend, there are still some upward expectations, but insufficient efforts were then suppressed by short opening. On the one hand, after the futures price rose to a relatively high level, the naked spot that was not hedged in the early stage had the demand to intervene in hedging policies. In addition, from the mentality analysis of the industrial chain, in the case of long-term weakness, some positions think that the rebound has become an opportunity to intervene in the layout of empty orders. The cultural index strengthened on Monday, with most commodities recording gains, especially the strong performance of Shuangjiao. Although PVC is upward, it is not strong enough. The technical level shows that the lower track of the Bolin belt (13, 13, 2) turns upward, and the KD line at the daily level shows a golden fork trend. In the short term, there is still a small upward probability of the futures price, but the space above is expected to narrow.

Spot: from the performance of the futures market, there is a certain pressure above the prefix 6. On the one hand, it is relatively difficult to break through the integer gate at the technical level, on the other hand, there is not much support for the current PVC fundamentals. The temporary stability of PVC supply has not heard of the emergence of larger variables, downstream product enterprises are available on demand, and in view of the current weak market, traders still have sales pressure, so the relatively weak fundamentals also affect the futures market high point is difficult to have a better and high performance. Shuangjiao rose sharply today, the overall mood of commodities has also been repaired, PVC is also affected to follow the overall disk shows a strong operation trend. At present, after entering the fourth quarter, the policy port stimulation and guidance are insufficient, and it is difficult for the factors close to PVC itself to support the sharp rise in the prices of the two cities, but there is also a lack of factors at present. As a whole, from the current short-term point of view, the spot market price of PVC still has some repair opportunities, but in the long and medium term, we think the pressure exists.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.13 |

Price 10.16 |

Rate of change |

|

V2401 collection |

5955 |

5973 |

18 |

|

|

Average spot price in East China |

5855 |

5875 |

20 |

|

|

Average spot price in South China |

5910 |

5935 |

25 |

|

|

PVC2401 basis difference |

-100 |

-98 |

2 |

|

|

V2405 collection |

6063 |

6079 |

16 |

|

|

V2401-2405 closed |

-108 |

-106 |

2 |

|

|

PP2401 collection |

7473 |

7517 |

44 |

|

|

Plastic L2401 collection |

8021 |

8055 |

34 |

|

|

V--PP basis difference |

-1518 |

-1544 |

-26 |

|

|

Vmure-L basis difference of plastics |

-2066 |

-2082 |

-16 |

|

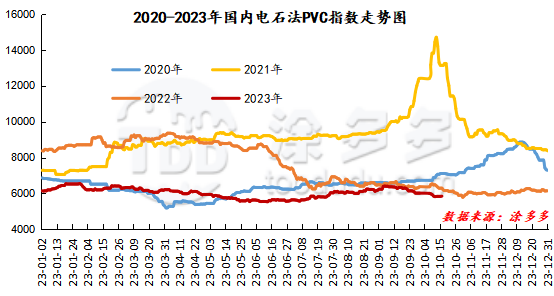

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 13.55, or 0.232%, to 5850.50 on October 16. The ethylene PVC spot index was 6174.21, down 37.62, with a range of 0.606%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 323.71.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.13 warehouse orders |

10.16 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,292 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,124 |

9,409 |

285 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

29,796 |

30,081 |

285 |

|

Total |

|

29,796 |

30,081 |

285 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.