- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

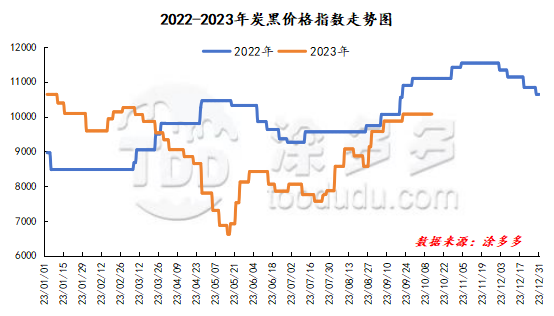

Foreword: At the end of September, the carbon black market lived up to expectations. The price of new orders was increased again. Some models rose again to 10,000 yuan per ton. After a lapse of six months, carbon black once again returned to the "10,000 yuan era." As of now, the carbon black market price index is 10,071.25. At this time, the carbon black market is very lively and multiple factors occupy the market. Let us make a detailed analysis:

Positive aspects:

1. The overall profit of the carbon black market is relatively good. Affected by the fluctuations in the price of raw material coal tar in the early stage, most carbon black companies still have carbon black produced by high-priced oil in the early stage, and the terminal price of carbon black has been severely depressed. Carbon black companies have suffered serious losses. In order to recover profits, carbon black prices have continued to push up. Up to now, the profits of carbon black companies have increased and their operations are in good condition.

2. The overall inventory of carbon black market is low. In the early stage, raw material prices fluctuated upward. Some carbon black companies began to suspend production and maintenance of equipment in order to control production costs. Coupled with the weak demand from downstream companies, the overall enthusiasm of carbon black companies to start construction weakened. The overall inventory of the industry is low, and some models are in short supply. Recently, some production line maintenance companies have resumed normal operation, and the operating rate has increased. However, the inventory of carbon black manufacturers is still not high, and the overall market supply is relatively tight.

3. In some areas, raw material prices are high and supplies are in short supply. Affected by environmental pollution, some 4.3-meter coke ovens in Shanxi have been completely shut down, eliminating tens of millions of tons of coal tar production capacity, reducing the supply of coal tar in Shanxi, and downstream carbon black companies are actively receiving goods. There are many positive factors in the coal tar field, and the market price has successfully pushed up, which has strong support for the cost side of carbon black.

4. The downstream tire industry has good demand. With the arrival of "Golden September and Silver Ten", downstream tire companies have entered the traditional sales peak season. With strong support from the cost side, tire companies have announced price increases one after another. Affected by market buying up or not buying down, tire shipments have been smoother than in the previous period. Some companies have successfully implemented price increases, currently maintaining a high production schedule, and performing well on carbon black demand.

Negative aspects:

1. Imported low-cost carbon black hits the Chinese market. China's carbon black market prices remain high, and terminals are highly resistant to China's high-priced carbon black supply. Some downstream companies choose to purchase imported carbon black. Moreover, the Russia-Ukraine War continues. A large amount of low-priced Russian carbon black has been imported into China, suppressing China's carbon black market price.

2. Demand from the downstream rubber products and plastic masterbatch industries is weak. The demand of rubber products companies is weak and difficult to change. Terminal merchants are less enthusiastic about getting goods. The profits of some rubber products companies have shrunk significantly. They mainly purchase carbon black raw materials on demand, and the actual transaction volume is average.

In future generations, the overall trend of the carbon black market may be quite impressive. The starting level of downstream tire companies is on the high side. Driven by the higher coal tar market, terminals are more active in entering the market, and demand for the carbon black market is in a relatively strong state. It is expected that there will be room for upward adjustment in the carbon black market in the short term.