- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: September 26th V2401 contract opening price: 6241, highest price: 6256, lowest price: 6163, position: 834047, settlement price: 6212, yesterday settlement: 6271, down: 59, daily trading volume: 998985 lots, precipitated capital: 3.604 billion, capital outflow: 1.49 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.25 |

Price 9.26 |

Rise and fall |

Remarks |

|

North China |

6060-6120 |

6000-6090 |

-60/-30 |

Send to cash remittance |

|

East China |

6090-6190 |

6030-6160 |

-60/-30 |

Cash out of the warehouse |

|

South China |

6150-6250 |

6100-6230 |

-50/-20 |

Cash out of the warehouse |

|

Northeast China |

6050-6200 |

6000-6150 |

-50/-50 |

Send to cash remittance |

|

Central China |

6080-6120 |

6070-6080 |

-10/-40 |

Send to cash remittance |

|

Southwest |

6050-6200 |

6000-6100 |

-50/-100 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell again weak in various regions, the market atmosphere continues to be poor. Compared with the valuation, it fell by 30-60 yuan / ton in North China, 30-60 yuan / ton in East China, 20-50 yuan / ton in South China, 50 yuan / ton in Northeast China, 10-40 yuan / ton in Central China and 50-100 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises held a wait-and-see attitude, and there was no obvious adjustment. Some enterprises still lowered 50 yuan / ton, and the quotations of traders in various regions of the spot market declined, especially when the afternoon price was lower than that of yesterday. After the futures price was weaker, the point price source price advantage was obvious, and the basis offer was slightly adjusted, including East China basis offer 01 contract-(50-70-130,150). South China 01 contract-(0-30-80-120), North 01 contract-(350-400-500), Southwest 01 contract-(250). On the whole, there is no advantage in today's high price, most point-to-point shipments, downstream procurement enthusiasm is OK, but part of the order price is low, the spot market trading is OK.

From the perspective of futures: PVC2401 contract night futures prices fluctuate in a narrow range, while intraday futures prices are slightly weaker. After the start of morning trading, the price continued on the basis of night trading, but then fell in late morning and fell more sharply in the afternoon, falling below 6200 and hitting a low of 6163. 2401 contracts range from 6163 to 6256 throughout the day, with a spread of 93. 01 contracts with an increase of 9538 positions and 834047 positions so far. The 2405 contract closed at 6233, with 77713 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices have fallen five times since the middle track, in which the low point of last Friday's iterative weekly two-week price run three times through the support level of the lower rail of the Bollinger belt, forming an obvious downward trend. The support level of the lower rail is not effective, and the futures price continues to fall deeply. The technical level shows that the Bollinger belt (13, 13, 2) shows that the opening of the middle and lower rail is obvious, the upper rail turns slightly upward, and the opening of the third rail diverges. However, the trend of KD line and MACD line at the daily level is expanding. Combined with the current time node, the operating high point of the futures price will be limited only two trading days away from the National Day. In the short term, the operation of futures prices may continue the trend of low operation, and continue to observe the performance in the range of 6150-6250.

Spot aspect: & the continuous decline of the nbsp; futures price, although the low point hovering makes the atmosphere of the two cities bad, but the corresponding point price inquiry is slightly active, the product enterprises are low to hang orders, and there is a certain low point order transaction in the overall spot market. From the point of view of mentality, there is a certain acceptance psychology in the point of taking goods below 6200, that is, there is a certain enthusiasm for taking goods, but the transaction is not hot. At present, the operation of the two cities to replenish goods at low prices has become the norm. In the outer disk, prices in the international crude oil futures market were mixed, with US WTI oil prices falling below the $90 / barrel mark as the Federal Reserve may keep interest rates high, boosting the dollar and Russia announced the relaxation of oil export bans. In addition, the international market expects that the positive economic data to be released by China this week will boost market sentiment. On the whole, the spot market before the festival may continue the trend of low-level consolidation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.25 |

Price 9.26 |

Rate of change |

|

V2401 collection |

6247 |

6173 |

-74 |

|

|

Average spot price in East China |

6140 |

6095 |

-45 |

|

|

Average spot price in South China |

6200 |

6165 |

-35 |

|

|

PVC2401 basis difference |

-107 |

-78 |

29 |

|

|

V2405 collection |

6304 |

6233 |

-71 |

|

|

V2401-2405 closed |

-57 |

-60 |

-3 |

|

|

PP2401 collection |

7789 |

7731 |

-58 |

|

|

Plastic L2401 collection |

8258 |

8230 |

-28 |

|

|

V--PP basis difference |

-1542 |

-1558 |

-16 |

|

|

Vmure-L basis difference of plastics |

-2011 |

-2057 |

-46 |

|

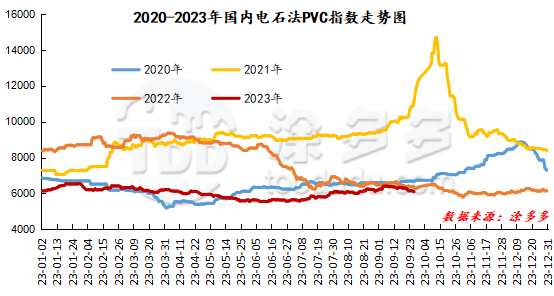

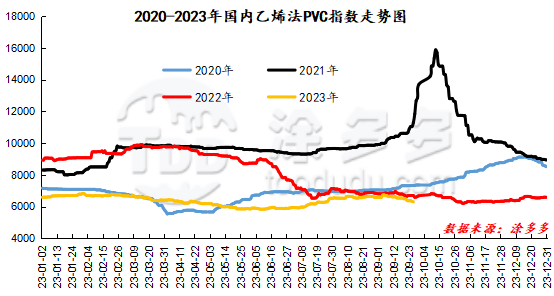

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 43.33, or 0.706%, to 6092.37 on Sept. 26. The ethylene PVC spot index was 6297.24, down 33.38, with a range of 0.527%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 204.87.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.25 warehouse orders |

9.26 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,292 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,224 |

9,224 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,781 |

1,781 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

0 |

0 |

0 |

|

PVC subtotal |

|

29,253 |

29,253 |

0 |

|

Total |

|

29,253 |

29,253 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.