- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Carbon black market analysis

Today, China's carbon black market is operating steadily at a high level. As of now, the mainstream price of N330 in the carbon black market is between 9,600 - 10,400 yuan/ton.

Cost: Today, China's high-temperature coal tar market is quietly watching. As the Double Festival approaches, shipments of coke enterprises are more urgent. Carbon black enterprises have started construction and upgraded, and are more active in receiving goods in the market. Other deep-processing enterprises have poor sales and procurement is mainly based on just-needed needs. The coal tar market is short and short, which has a strong impact on the cost side of carbon black. Support performance is average.

Supply: Recently, purchase orders from tire companies have increased, inventories in the carbon black industry are low, and some models are in short supply.

On the demand side: The profits of some rubber products companies have been severely reduced, the demand for carbon black has not increased significantly, and the actual transaction volume is average; the downstream tire industry has low carbon black stocks and sufficient recent orders, which has better support for carbon black, and the demand side is generally good for the market.

2. Carbon black market price

|

Carbon black market price on September 26 |

|||||

|

specifications |

market |

September 25 |

September 26 |

rise and fall |

units |

|

N330 |

Shanxi |

9600-10000 |

9600-10000 |

0 |

Yuan/ton |

|

Hebei |

10100-10400 |

10100-10400 |

0 |

Yuan/ton |

|

|

Guangzhou |

10000-10300 |

10000-10300 |

0 |

Yuan/ton |

|

|

Shandong |

9800-10200 |

9800-10200 |

0 |

Yuan/ton |

|

|

Zhejiang |

10000-10300 |

10000-10300 |

0 |

Yuan/ton |

|

|

Henan |

10100-10400 |

10100-10400 |

0 |

Yuan/ton |

|

|

N220 |

Shanxi |

10800-11100 |

10800-11100 |

0 |

Yuan/ton |

|

Hebei |

11600-12000 |

11600-12000 |

0 |

Yuan/ton |

|

|

Guangzhou |

11300-11600 |

11300-11600 |

0 |

Yuan/ton |

|

|

Shandong |

10900-11200 |

10900-11200 |

0 |

Yuan/ton |

|

|

Zhejiang |

11100-11400 |

11100-11400 |

0 |

Yuan/ton |

|

|

Henan |

11600-12000 |

11600-12000 |

0 |

Yuan/ton |

|

|

N550 |

Shanxi |

10000-10300 |

10000-10300 |

0 |

Yuan/ton |

|

Hebei |

10400-10700 |

10400-10700 |

0 |

Yuan/ton |

|

|

Guangzhou |

10500-10800 |

10500-10800 |

0 |

Yuan/ton |

|

|

Shandong |

10100-10500 |

10100-10500 |

0 |

Yuan/ton |

|

|

Zhejiang |

10400-10700 |

10400-10700 |

0 |

Yuan/ton |

|

|

Henan |

10400-10700 |

10400-10700 |

0 |

Yuan/ton |

|

|

N660 |

Shanxi |

9600-10000 |

9600-10000 |

0 |

Yuan/ton |

|

Hebei |

10100-10400 |

10100-10400 |

0 |

Yuan/ton |

|

|

Guangzhou |

10000-10300 |

10000-10300 |

0 |

Yuan/ton |

|

|

Shandong |

9800-10200 |

9800-10200 |

0 |

Yuan/ton |

|

|

Zhejiang |

10000-10300 |

10000-10300 |

0 |

Yuan/ton |

|

|

Henan |

10100-10400 |

10100-10400 |

0 |

Yuan/ton |

|

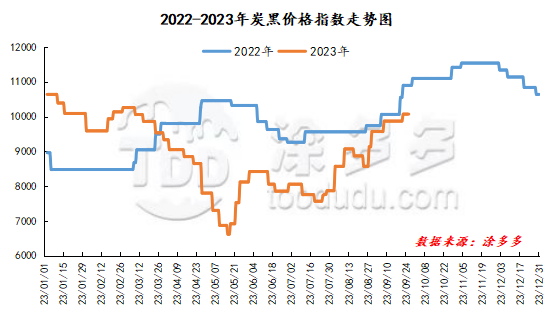

3. Carbon black index analysis

According to Tdd-global's data, the carbon black price index on September 26 was 10,071.25, which was the same as yesterday.

4. market outlook

In the short term, the raw coal tar market is running smoothly, and the support for the cost side of carbon black is weak; carbon black companies have made a firm offer price due to serious losses in the early stage; with the arrival of the two-season holiday, the downstream tire industry has a strong attitude towards stocking, and inquiries about carbon black entering the market are relatively positive. The carbon black market is expected to remain high in the short term.