- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: September 20 V2401 contract opening price: 6498, highest price: 6543, lowest price: 6401, position: 805320, settlement price: 6472, yesterday settlement: 6425, up: 47, daily trading volume: 1301845 lots, precipitated capital: 3.619 billion, capital outflow: 73.93 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.19 |

Price 9.20 |

Rise and fall |

Remarks |

|

North China |

6250-6300 |

6260-6290 |

10/-10 |

Send to cash remittance |

|

East China |

6280-6350 |

6260-6350 |

-20/0 |

Cash out of the warehouse |

|

South China |

6350-6440 |

6330-6400 |

-20/-40 |

Cash out of the warehouse |

|

Northeast China |

6200-6300 |

6100-6300 |

-100/0 |

Send to cash remittance |

|

Central China |

6230-6250 |

6230-6250 |

0/0 |

Send to cash remittance |

|

Southwest |

6150-6250 |

6150-6250 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price center of gravity is loose, as we said the recent frequent price adjustments. According to the comparison of valuation, the low-end price in North China rose by 10 yuan / ton, the high-end price dropped by 10 yuan / ton, East China fell by 20 yuan / ton, South China fell by 20-40 yuan / ton, and Northeast China fell by 100 yuan / ton. central China and southwest China are stable. Upstream PVC production enterprises factory prices mostly remain stable, very few enterprises up 50 yuan / ton, futures prices high open low daytime market downward, lack of offer mentality of businessmen in various regions, high prices are not lasting, although there is a wait-and-see mentality, but there is no choice but to drop openly and steadily in exchange for a better shipment transaction. The one-mouth offer was lower than yesterday, and some of it was lowered again in the afternoon, with the high price barely closed. After the futures price went down, the point price source price advantage gradually appeared, and the basis offer was weaker than yesterday, including East China base offer 01 contract-(70-150), South China 01 contract-(20-50-100), North 01 contract-(350-400-500), Southwest 01 contract-(250). On the whole, the purchasing enthusiasm of the downstream is not high, and the order price is on the low side.

Futures point of view: PVC2401 contract night futures prices continue to rise slightly, but the range is limited to a high of 6543. After the start of morning trading, the price of the futures all the way down, the decline is obvious. Afternoon prices fluctuated at a relatively low level, with a relatively narrow range of volatility until the end of late trading. 2401 contracts range from 6401 to 6543 throughout the day, with a spread of 142. 01 contracts reduced their positions by 7839 positions, and so far they have held 805320 positions. The 2405 contract closed at 6465, with 66327 positions.

PVC Future Forecast:

Futures: PVC2401 contract futures prices run on the basis of yesterday, futures prices further rose, but relatively as we expected a high degree of restrictions, and then prices fell sharply during the day, on the one hand, showing a certain trend of retail profit-taking, in which Kongping 25.6% vs. Duoping 24.3% both sides left. On the other hand, there are more short orders at high futures prices, and 24.1% of short orders are significantly suppressed compared with 22.0% more. The upward trend of the futures price comes from the macro level and the lack of fundamental support, so the high point of the futures price is difficult to sustain and then return to the shock near the middle rail, the technical level shows that each trend line still ends poorly, we still maintain the previous point of view. the habitual operation of futures prices continues to observe the performance in the range of 6300-6500.

Spot: futures market has a certain nature of repetition, first of all, the upward high point of the futures price is limited, although there is some single sentiment, but the high risk increases, it is difficult to attract large funds to enter the market, but the current level will also face a dilemma of rise and fall, even if the decline is also difficult to fall under the expectations of the end of the third quarter of gold, silver and silver. The spot market also appears the situation of frequent price adjustment, and the variables from the fundamentals are weak, whether it is the downward price of Formosa Plastics in China and Taiwan, or the weakening of calcium carbide prices, to a certain extent, make the fundamentals of PVC more weak. Therefore, high prices are difficult to form a long-term support. The following fourth quarter, in the face of the traditional off-season, as well as the continued poor performance of real estate data, the overall market of PVC may face some pressure. Therefore, although short-term spot market prices may still be arranged in a relatively high and narrow range, there may still be contradictions in the medium and long term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.19 |

Price 9.20 |

Rate of change |

|

V2401 collection |

6488 |

6420 |

-68 |

|

|

Average spot price in East China |

6315 |

6305 |

-10 |

|

|

Average spot price in South China |

6395 |

6365 |

-30 |

|

|

PVC2401 basis difference |

-173 |

-115 |

58 |

|

|

V2405 collection |

6530 |

6465 |

-65 |

|

|

V2401-2405 closed |

-42 |

-45 |

-3 |

|

|

PP2401 collection |

8073 |

7972 |

-101 |

|

|

Plastic L2401 collection |

8520 |

8384 |

-136 |

|

|

V--PP basis difference |

-1585 |

-1552 |

33 |

|

|

Vmure-L basis difference of plastics |

-2032 |

-1964 |

68 |

|

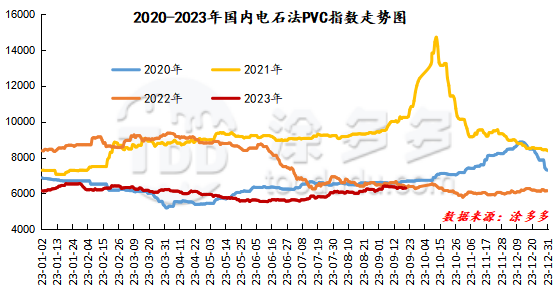

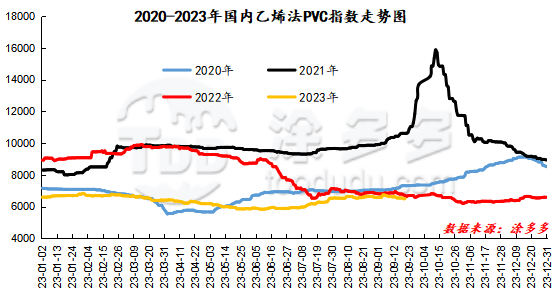

China PVC Index: according to Tudou data, the Chinese calcium carbide PVC spot index fell 12.68, or 0.201%, to 6288.17 on Sept. 20. The ethylene PVC spot index was 6500.85, up 9.43, with a range of 0.145%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 212.68.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.19 warehouse receipts |

9.20 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,417 |

2,417 |

-1,000 |

|

Polyvinyl chloride |

Peak supply chain |

1,392 |

1,392 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,592 |

9,586 |

-6 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,181 |

1,781 |

-400 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

31,151 |

29,745 |

-1,406 |

|

Total |

|

31,151 |

29,745 |

-1,406 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.