- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: September 18 V2401 contract opening price: 6430, highest price: 6450, lowest price: 6350, position: 794685, settlement price: 6396, yesterday settlement: 6434, down: 38, daily trading volume: 1407898 lots, precipitated capital: 3.555 billion, capital inflow: 15.07 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.15 |

Price 9.18 |

Rise and fall |

Remarks |

|

North China |

6260-6320 |

6210-6290 |

-50/-30 |

Send to cash remittance |

|

East China |

6300-6380 |

6230-6330 |

-70/-50 |

Cash out of the warehouse |

|

South China |

6350-6450 |

6310-6400 |

-40/-50 |

Cash out of the warehouse |

|

Northeast China |

6250-6400 |

6200-6300 |

-50/-100 |

Send to cash remittance |

|

Central China |

6300-6400 |

6230-6300 |

-70/-100 |

Send to cash remittance |

|

Southwest |

6150-6250 |

6100-6200 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price center fell slightly, the beginning of the week atmosphere is not good. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 50-70 yuan / ton in East China, 40-50 yuan / ton in South China, 50-100 yuan / ton in Northeast China, 70-100 yuan / ton in Central China, and 50 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices began to cut 50-100 yuan / ton to promote transactions, some enterprises are still stable prices wait and see, but on Monday there are not many contracts signed market transactions slightly light. The futures price is high, low and weak, and it is difficult to close the deal with a high offer in the spot market, and the point price supply has a certain price advantage, including East China basis offer 01 contract-(50-70-140), South China 01 contract-(0-30-50-100), North 01 contract-(350-380-500), Southwest 01 contract-(250). Although the point price and a mouthful offer coexist, but according to the feedback of the merchants, the two offer methods are not good, the lower reaches of the early bargain for an appropriate amount of replenishment, the beginning of the week to hang orders is not high, and a mouthful price does not have an advantage, the overall transaction is general.

From a futures point of view: & the nbsp; PVC2401 contract opened high and opened low on Friday night, and the intraday price was slightly weaker. After the start of morning trading on Monday, futures prices quickly fell to the lowest point of 6350, but the bottom rebounded but the upward strength was not strong enough, only to run a narrow afternoon consolidation above 6400. 2401 contracts fluctuate in the range of 6350-6450 throughout the day, with a spread of 100,001 and an increase of 11095 positions, with 794685 positions so far. The 2405 contract closed at 6436, with 60511 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices continue to linger between the lower tracks of the Bollinger belt (13, 13, 2), and the operation of futures prices shows a certain degree of resilience, as we expected, the overall September market at the end of the third quarter is faced with a dilemma. Since the decline in the peak, there is not enough support to stimulate the further strengthening of the price of the period, and the funds are not willing to take too much risk, and the activity has declined. On the other hand, the operation of the futures price comes from the weak support of the fundamentals, so it can not show a better high rising trend, but comes from the hedging policy of the spot digestion pressure to suppress the disk. We still maintain the early judgment that the operation of the futures price will still be narrow and intertwined. The performance in the range of 6300-6500 was observed in the short term.

Spot aspect: period the operation of the two cities is relatively weak, although from a macro point of view, the third quarter policy frequently, real estate also issued a series of policy incentives, but the monthly performance of real estate data is poor, compared with the overall weakness after the Spring Festival and the second quarter, since the low point rose in the third quarter, there has indeed been a certain improvement. However, to continue to rise, whether in terms of policy, macro or fundamentals, there is a lack of certain motivation, and the time begins to gradually enter the fourth quarter, the pressure of supply and demand may form pressure on the two cities in the future. This is also on the one hand, the spot market, whether production enterprises or traders are feedback, even if the rising market shipping pressure is also greater, on the one hand, downstream products enterprises buy down do not buy up, the market upward mood is not enough, high prices conflict with the procurement slowdown. Recent cost port calcium carbide prices downward, overall short-term spot market still maintain a narrow volatility trend, medium-and long-term pressure.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.15 |

Price 9.18 |

Rate of change |

|

V2401 collection |

6453 |

6390 |

-63 |

|

|

Average spot price in East China |

6340 |

6280 |

-60 |

|

|

Average spot price in South China |

6400 |

6355 |

-45 |

|

|

PVC2401 basis difference |

-113 |

-110 |

3 |

|

|

V2405 collection |

6495 |

6436 |

-59 |

|

|

V2401-2405 closed |

-42 |

-46 |

-4 |

|

|

PP2401 collection |

7970 |

7991 |

21 |

|

|

Plastic L2401 collection |

8417 |

8430 |

13 |

|

|

V--PP basis difference |

-1517 |

-1601 |

-84 |

|

|

Vmure-L basis difference of plastics |

-1964 |

-2040 |

-76 |

|

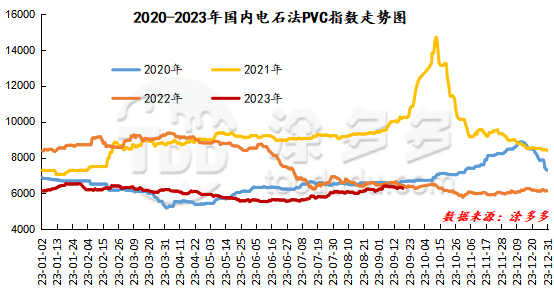

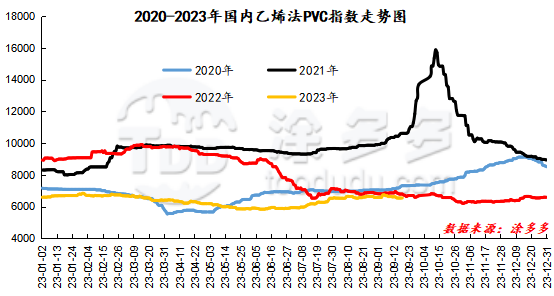

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 55.66, or 0.879%, to 6275 on Sept. 18. The ethylene PVC spot index was 6540.32, up 3.85, with a range of 0.059%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 265.32.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.15 warehouse orders |

9.18 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,417 |

3,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,392 |

1,392 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,592 |

9,592 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,181 |

2,181 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

31,151 |

31,151 |

0 |

|

Total |

|

31,151 |

31,151 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.