- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

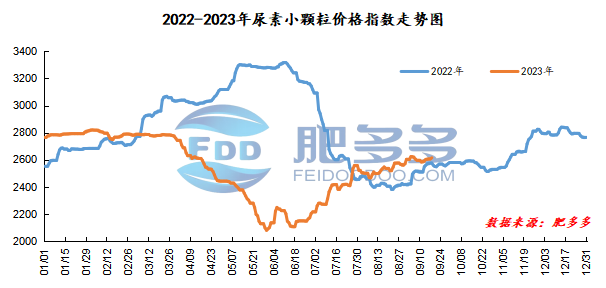

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 18 was 2,614.68, up 8.64 from last Friday, up 0.33% month-on-month, and up 1.52% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2251, the highest price is 2286, the lowest price is 2236, the settlement price is 2269, and the closing price is 2270. The closing price is up 42 compared with the settlement price of the previous trading day, and the month-on-month increase is 1.89%. The daily fluctuation range is 2236-2286, and the price difference is 50; the 01 contract has increased its position by 3080 lots today, and so far, it has held 331572 lots.

Spot market analysis:

Today, China's urea market prices continued to be firm, and some companies slightly increased their factory quotations.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,560 yuan/ton. Prices in North China rose to 2,480 - 2,670 yuan/ton. Prices in the northwest region rose to 2,560 - 2,570 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China rose to 2,640 - 2,700 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,560 - 2,730 yuan/ton, and the price of large particles rose to 2,620 - 2,630 yuan/ton. Prices in South China fell to 2,620 - 2,740 yuan/ton.

Market outlook forecast:

On the supply side, the current Nissan increase rate of enterprises is slow, and inventories are low. Some enterprises are still waiting for the transaction. New orders are still available. The overall market supply is tight, which is good for price increases. In addition, Shanxi's industrial production restriction plan to reduce air pollution in autumn and winter has been approved this week, and the results will be announced in the near future. In the later stage, attention needs to be paid to the extent of its production restriction efforts. In terms of demand, the operating rate of downstream compound fertilizers has increased this year, and the demand for urea has increased; some companies have announced that they will postpone the entry into the market for national chemical fertilizer commercial reserves during the off-season, which may lead to a reduction in demand at this stage.

On the whole, the current market supply is low, Nissan is slowly increasing, and market demand still exists. Therefore, it is expected that the spot price of urea in the short term will mainly be large, stable and small.