- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

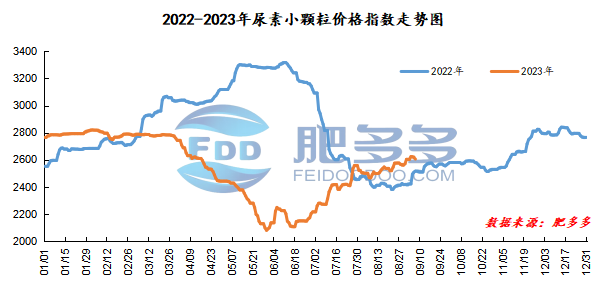

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 7 was 2,605.14, down 10 from yesterday, down 0.38% month-on-month, and up 3.53% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2207, the highest price is 2207, the lowest price is 2064, the settlement price is 2121, and the closing price is 2094. The closing price is down 118 compared with the settlement price of the previous trading day, down 5.33% month-on-month. The daily fluctuation range is 2064-2207, and the spread is 143; the 01 contract has increased its position by 15136 lots today, and so far, it has held 341244 lots.

Spot market analysis:

Today, China's urea market price fell slightly. Most companies lowered their quotations slightly. Some companies 'quotations remained stable, and the overall new order transaction volume declined.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,560 yuan/ton. Prices in North China fell to 2,410 - 2,600 yuan/ton. Prices in the northwest region are stable at 2,580 - 2,590 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China fell to 2,630 - 2,680 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,510 - 2,730 yuan/ton, and the price of large particles stabilized at 2,620 - 2,640 yuan/ton. Prices in South China fell to 2,620 - 2,730 yuan/ton.

Market outlook forecast:

On the enterprise side, enterprises still continue to execute domestic demand and export orders, and inventories continue to remain low. Affected by equipment maintenance, Nissan has decreased relatively, spot supply has been tight, and supply has not changed much. On the downstream side, there is still a demand for downstream compound fertilizers. Due to the rise in raw material prices, the downstream procurement cycle has been shortened and dealers have increased the cost of getting goods, so they have to purchase small quantities on demand. In terms of market sentiment, affected by the recent deviation of urea market prices from the fundamentals of supply and demand, some associations are currently calling for rational management and avoiding following suit. Recently, many companies issued supply guarantees proposals, mentioning that they should give priority to supplying Chinese demand and partially reduce exports., etc., the market will not be out of stock.

On the whole, due to the current high price, the market is highly resistant. It is expected that the spot price of urea will gradually fall in the short term. However, due to the low supply, the price decline will be limited.