- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

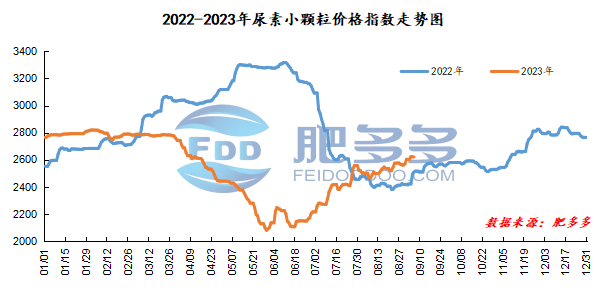

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 6 was 2,615.14, down 5.45 from yesterday, down 0.21% month-on-month, and up 4.24% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract: 223, the highest price: 2236, the lowest price: 2185, the settlement price: 2212, and the closing price: 2224. The closing price dropped by 3 compared with the settlement price of the previous trading day, and the month-on-month decline was 0.14%. The daily fluctuation range is 2185-2236, and the spread is 51; The 01 contract has increased its positions by 7239 lots today, and so far, it has held 326108 lots.

Spot market analysis:

Today, China's urea market prices are being consolidated and running. Companies 'quotations are stable, new orders are under great pressure, inventories are low, and manufacturers are wait-and-see.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,560 yuan/ton. Prices in North China fell to 2,480 - 2,630 yuan/ton. Prices in the northwest region are stable at 2,580 - 2,590 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China fell to 2,630 - 2,700 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,530 - 2,750 yuan/ton, and the price of large particles stabilized at 2,620 - 2,640 yuan/ton. Prices in South China are stable at 2,650 - 2,750 yuan/ton.

Market outlook forecast:

In terms of enterprises, most companies currently have sufficient support from pending orders, and favorable quotations continue to rise. In addition, some enterprises have still stopped for equipment maintenance recently, and there are not a small number of enterprises parking in the early stage, resulting in the current operating rate being still low and the supply side is good. In terms of the market, there is still demand for compound fertilizers to be prepared in autumn. However, due to the impact of high market prices, downstream procurement is currently cautious, and most of them are based on wait-and-see. Some companies with small inventories just need to replenish a small amount. Internationally, India issued a new round of urea import bidding announcement yesterday afternoon. The bidding will be closed on September 15. The quotation will be valid until September 25, and the latest shipping date will be November 14. It is expected that this round of bidding will continue to affect China's urea market. Price changes.

On the whole, despite the recent market news, the spot market is still mainly cautious and needs replenishment, and the urea spot price range is expected to fluctuate in the short term.