- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: September 5th V2401 contract opening price: 6514, highest price: 6591, lowest price: 6471, position: 709001, settlement price: 6535, yesterday settlement: 6496, up: 39, daily trading volume: 1068126 lots, precipitated capital: 3.243 billion, capital inflow: 54.52 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.4 |

Price 9.5 |

Rise and fall |

Remarks |

|

North China |

6280-6370 |

6310-6390 |

30/20 |

Send to cash remittance |

|

East China |

6370-6470 |

6400-6470 |

30/0 |

Cash out of the warehouse |

|

South China |

6400-6520 |

6430-6550 |

30/30 |

Cash out of the warehouse |

|

Northeast China |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

|

Central China |

6450-6480 |

6450-6480 |

0/0 |

Send to cash remittance |

|

Southwest |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices basically maintain a stable and small movement model, a few sporadic increases. Compared with the valuation, it rose 20-30 yuan / ton in North China, 30 yuan / ton in East China, 30 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. The ex-factory prices of upstream PVC production enterprises still have supplementary rising behavior, and most of the increases are concentrated in 50-100 yuan / ton, including the synchronous upward price of northwest enterprises in different places. The futures price is still high and fluctuating, but under the condition of little price change, the offer range of traders in the spot market is sorted out, and the price offer in some areas is still raised, and the strong futures price has a certain supporting effect on the spot market, but at present, the spot price advantage is small, and the base difference does not change much, including East China base offer 01 contract-(50-80), South China 01 contract-(0-80). North 01 contract-(450), southwest 01 contract-(260). On the whole, it is difficult to close a deal at a high price in the spot market, with small negotiations, lower enthusiasm for downstream procurement, tight supply of some brands and slightly higher prices.

Futures point of view: PVC2401 contract night market narrow finishing mainly, the late market price rose slightly and the night market showed the lowest point of 6471. After the start of morning trading, futures surpassed yesterday's highs, but afternoon prices fell and gave up gains. 2401 contracts fluctuate in the range of 6471-6591 throughout the day, with a spread of 120,001 and an increase of 9778 positions, with 709001 positions so far. The 2405 contract closed at 6565, with 43085 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices run to repeat yesterday's trajectory, intraday prices shot up obviously and today refreshed before the highest point of 6561, nearly broke the 6600 mark. However, in late trading, on the one hand, retail investors took profits from multiple orders, and on the other hand, the suppression of high futures prices led to the downside of afternoon prices to give up some of the gains. The futures price returned to the opening price and fluctuated up and down. Although the futures price is at a new high, there is a vaguely high horizontal trend in terms of the trajectory and range. The technical level shows that the opening of the Bollinger belt (13, 13, 2) is still upward, and the price is still positive cross star, daily-level KD line and MACD still show a golden cross trend. We continue to maintain the previous view that the operation of the main company will still be high and narrow, and the front high of the main company is still hopeful but vigilant against risks.

Spot aspect: First of all, after the cultural commodity index reached a high of 193.06 yesterday, there is a downward trend today, and some varieties with strong early trends began to weaken and decline. From the overall mood, PVC only showed a certain strong trend after most active commodities weakened, and there is a certain lag in time, so although the high point is still expected, the expected range may be limited. This is also the reason why there were two consecutive days of highs but gave up the increase in the afternoon. The excessively high price funds of the two cities are not willing to take the risk of continuing to rise, and the current fundamentals are not supported by more favorable factors. At present, the supply of goods in the spot market is still not digested smoothly, and spot merchants are also considering to intervene in hedging at the appropriate basis. In the outer disk, international oil prices closed higher on expectations that OPEC+ producers would keep oil supplies tight and speculation that the Fed would stop aggressive interest rate hikes. On the whole, the PVC spot market will still be high and narrow in the short term, but be on guard against risks.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

9.4 |

9.5 days |

Rate of change |

|

V2401 collection |

6515 |

6535 |

20 |

|

|

Average spot price in East China |

6420 |

6435 |

15 |

|

|

Average spot price in South China |

6460 |

6490 |

30 |

|

|

PVC2401 basis difference |

-95 |

-100 |

-5 |

|

|

V2405 collection |

6539 |

6565 |

26 |

|

|

V2401-2405 closed |

-24 |

-30 |

-6 |

|

|

PP2401 collection |

7813 |

7871 |

58 |

|

|

Plastic L2401 collection |

8385 |

8401 |

16 |

|

|

V--PP basis difference |

-1298 |

-1336 |

-38 |

|

|

Vmure-L basis difference of plastics |

-1870 |

-1866 |

4 |

|

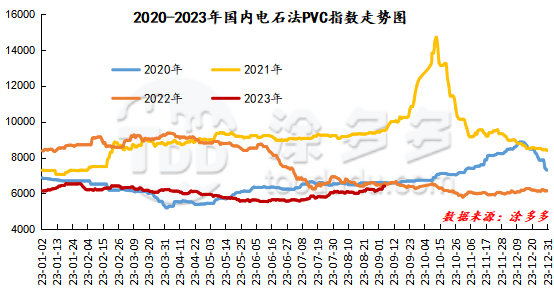

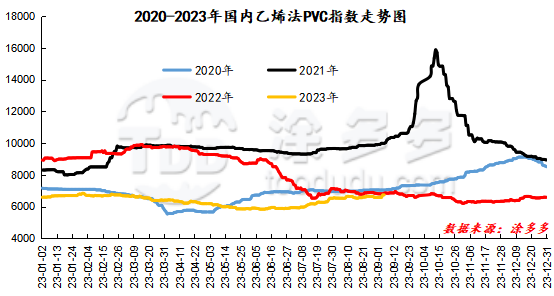

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 16.26, or 0.254%, to 6409.06 on Sept. 5. The ethylene method PVC spot index was 6735.81, up 11.8%, with a range of 0.175%. The calcium carbide method index rose, the ethylene method index rose, and the ethylene-calcium carbide index spread was 326.75.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.4 warehouse orders |

9.5 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

287 |

287 |

0 |

|

|

Zhenjiang Middle and far Sea |

287 |

287 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,205 |

1,205 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,755 |

7,297 |

542 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,124 |

2,240 |

116 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

170 |

70 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,319 |

26,047 |

728 |

|

Total |

|

25,319 |

26,047 |

728 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.