- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

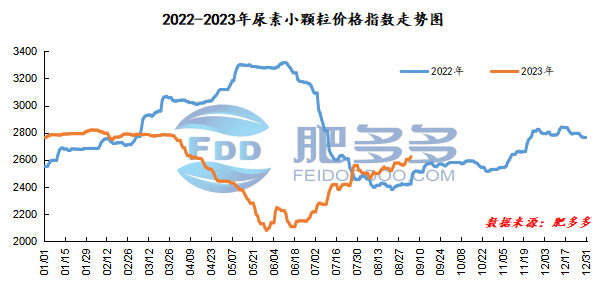

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 4 was 2,623.32, up 20 from last Friday, up 0.77% month-on-month, and up 8.33% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2240, the highest price: 2283, the lowest price: 2191, the settlement price: 2232, and the closing price: 2205. The closing price dropped by 151 compared with the settlement price of the previous trading day, and the month-on-month decline by 6.41%. The daily fluctuation range is 2191-2283, and the spread is 92; The 01 contract has increased its position by 14240 lots today, and has held 307602 lots so far.

Spot market analysis:

Today, China's urea market prices have increased overall, with increases ranging from 20 to 70 yuan/ton in various regions. The market trading atmosphere is relatively good.

Specifically, prices in Northeast China have risen to 2,500 - 2,560 yuan/ton. Prices in North China rose to 2,500 - 2,650 yuan/ton. Prices in Northwest China rose to 2,610 - 2,620 yuan/ton. Prices in Southwest China rose to 2,450 - 2,800 yuan/ton. Prices in East China rose to 2,640 - 2,700 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,550 - 2,750 yuan/ton, and the price of large particles rose to 2,620 - 2,640 yuan/ton. Prices in South China rose to 2,680 - 2,750 yuan/ton.

Market outlook forecast:

In terms of enterprises, some enterprises still carry out pre-receipt payments, with sufficient orders for urea products and a small number of new orders. In terms of supply, the inventory of urea companies continues to remain at a low level. Some companies have stopped equipment for maintenance, production capacity utilization has declined, supply of goods has shrunk, and short-term urea supply has been limited. In terms of demand, exports exceeding expectations and compound fertilizer companies 'concentrated start-up of production and replenishment of raw materials have jointly supported demand during the off-season, and China's demand has increased; at present, this round of Indian bidding has ended, and urea international market quotations have also been lowered. Foreign export demand has decreased, and India may have a new bidding plan in the later period, which may stimulate the current urea market. In addition, there were reports in the market over the weekend that legal inspections at ports were restricted, and China's urea exports may be blocked in the future.

On the whole, the urea market will still maintain a situation with low total supply and total demand. Inventory levels remain low and price support is strong. However, there is no obvious positive factors to stimulate and there is limited room for growth. It is expected that the spot price of urea will continue to remain at a small level in the short term. High shocks.