- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: September 4 V2401 contract opening price: 6420, highest price: 6588, lowest price: 6374, position: 699223, settlement price: 6496, yesterday settlement: 6340, up: 156, daily trading volume: 1579344 lots, precipitated capital: 3.189 billion, capital inflow: 169 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.1 |

Price 9.4 |

Rise and fall |

Remarks |

|

North China |

6130-6220 |

6280-6370 |

150/150 |

Send to cash remittance |

|

East China |

6230-6280 |

6370-6470 |

140/190 |

Cash out of the warehouse |

|

South China |

6280-6360 |

6400-6520 |

120/160 |

Cash out of the warehouse |

|

Northeast China |

6100-6250 |

6200-6350 |

100/100 |

Send to cash remittance |

|

Central China |

6260-6300 |

6450-6480 |

190/180 |

Send to cash remittance |

|

Southwest |

6050-6200 |

6200-6350 |

150/150 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rise, and the spot market is significantly better. Compared with the valuation, it rose 150 yuan / ton in North China, 140-190 yuan / ton in East China, 120-160 yuan / ton in South China, 100 yuan / ton in Northeast China, 180-190 yuan / ton in Central China and 150 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises is generally increased by 50-100 yuan / ton, and a few radical enterprises are directly increased by 150 yuan / ton, including ethylene enterprises. The strong upward high of the futures price continued to rise, and the offer mentality of traders in the spot market at the beginning of the week was sufficient. The price of each region went up sharply and some of the spot prices were offered, but the spot price advantage disappeared with the upward price of the futures price. East China base offer 01 contract-(50-80-120), South China 01 contract-(0-80), North 01 contract-(450), Southwest 01 contract-(260). Although the current prices of the two cities have risen sharply, but the merchants feedback that the delivery rhythm is not good, some hedgers take the goods, the actual single inquiry lacks enthusiasm, and the downstream is cautious to replenish the goods on the bargain.

From the futures point of view: & the nbsp; PVC2401 contract opened low and high on Friday night trading, showing a clear upward trend. After the start of morning trading on Monday, the futures price fluctuated in a narrow range, with the highest point of the second intraday rise to 6588, the trend remained strong, and the afternoon price fell somewhat. 2401 contracts fluctuate in the range of 6374-6588 throughout the day, with a spread of 214,01and an increase of 24015 positions, with 699223 positions so far. The 2405 contract closed at 6539, with 41376 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract prices showed an obvious upward trend, with a sudden rise throughout the day, and the cultural goods index led the list and rose 2.73%. The sharp rise in futures prices is beyond imagination, and most of the early commodities have risen, although PVC has also improved synchronously, but the performance in the overall commodity sector is not outstanding, not like soda ash, glass and urea. However, since last Friday, PVC has received attention, and the futures price rose sharply by more than 36000 positions at one time. Although the positions were partially closed in late trading, the trading throughout the day was still dominated by long opening, of which 23.5% was opened empty by 25.2%. The strong upward trend of the futures price makes the technology turn. The Bolin belt (13, 13, 2) opens upward, and the high point of the futures price rises on the track. in the short term, the operation of the futures price is still strong, or further consider the high position of the main link before 6700, but be on guard against the trend of reaching a peak in stages.

Spot: & the sharp rise in nbsp; futures and cash prices in the two cities has led to some hedgers taking goods. On the one hand, considering the appropriate basis between futures and cash, on the other hand, high prices have suppressed the demand for real orders downstream. From a fundamental point of view, the weak demand of the terminal has become an indisputable fact, which is also the recent strengthening of commodities, but the main reason why PVC has not received too much attention is that it does not have better fundamentals like star varieties. However, we have been emphasizing that the third quarter is expected to come, and the price increases in the two cities have reached a position around 6500, so although there is still a good performance in the future, we should be on guard against turning to the market. The price upward mostly comes from the stimulation of the real estate sector, of which the lower limit of interest rates for the first home loan of 31 places has all been released! With the two notices issued by the Central Bank and the State Administration of Financial Supervision and Administration on August 31, the stock mortgage interest rate officially ushered in a preliminary adjustment plan, and the minimum down payment ratio of commercial personal housing loans across the country was also uniformly adjusted. The stimulation of the real estate sector led to the strengthening of prices in the two markets of PVC. In the short term, the spot market of PVC will still be strong, but be on guard against risks.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

9.1 |

9.4 |

Rate of change |

|

V2401 collection |

6390 |

6515 |

125 |

|

|

Average spot price in East China |

6255 |

6420 |

165 |

|

|

Average spot price in South China |

6320 |

6460 |

140 |

|

|

PVC2401 basis difference |

-135 |

-95 |

40 |

|

|

V2405 collection |

6421 |

6539 |

118 |

|

|

V2401-2405 closed |

-31 |

-24 |

7 |

|

|

PP2401 collection |

7851 |

7813 |

-38 |

|

|

Plastic L2401 collection |

8420 |

8385 |

-35 |

|

|

V--PP basis difference |

-1461 |

-1298 |

163 |

|

|

Vmure-L basis difference of plastics |

-2030 |

-1870 |

160 |

|

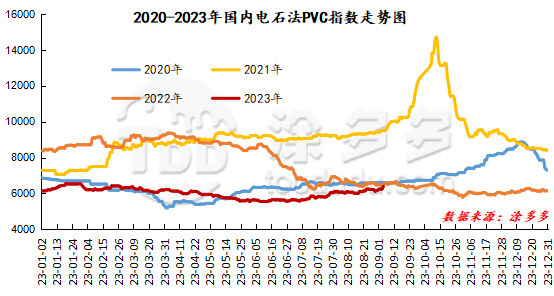

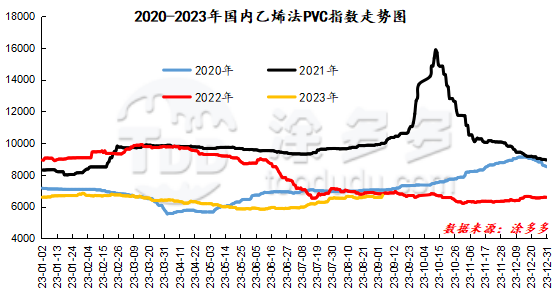

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 153.51, or 2.46%, to 6392.8 on Sept. 4. The ethylene method PVC spot index was 6724.01, up 142.28, with a range of 2.162%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 331.21.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.1 warehouse receipt quantity |

9.4 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

- |

0 |

|

|

Guangzhou materials |

141 |

- |

0 |

|

|

China Central Reserve Nanjing |

360 |

- |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

287 |

- |

0 |

|

|

Zhenjiang Middle and far Sea |

287 |

- |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

- |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

- |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,143 |

- |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,099 |

- |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

- |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

- |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,124 |

- |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

- |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

- |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

- |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

- |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

- |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

- |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

- |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

- |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

- |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

- |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

- |

0 |

|

PVC subtotal |

|

25,541 |

25,319 |

-222 |

|

Total |

|

25,541 |

25,319 |

-222 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.