- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Monoammonium phosphate price index:

According to Feiduo data, on August 31, China's 55% powder index of monoammonium phosphate was 3,071.43, rising; the 55% particle index was 2820, stable; and the 58% powder index was 3,266.67, rising.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market maintained an upward trend. In terms of enterprises, there are currently sufficient factories to ship, and most orders can be extended into mid-to-late September. Some enterprises are still suspended from quoting and receiving orders, and the transaction volume of new orders is small. In terms of cost, upstream cost support is strong, raw material ore prices have increased, and cost pressures have increased, supporting the high price of monoammonium. On the whole, the monoammonium market is supported by demand and demand, and the focus of transactions continues to rise. It is expected that the market price of monoammonium phosphate will continue to maintain a high level.

Specific market prices in each region are as follows:

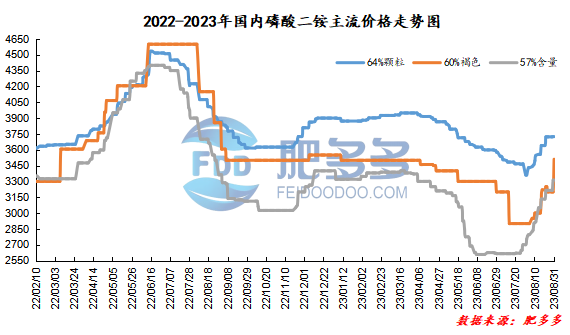

Diammonium phosphate price index:

According to Feiduo data, on August 31, the 64% particle index of China's mainstream diammonium phosphate was 3724, stable; the 60% brown index was 3510, rising; and the 57% content index was 3,212.5, stable.

Diammonium phosphate market analysis and forecast:

The market price of diammonium phosphate in China remains high today. On the enterprise side, enterprises still honor most orders received in advance in advance. The inventory is limited and the supply of goods is scarce. Spot quotations continue to rise, and actual transactions are negotiated on a single basis. In terms of demand, the current market demand for diammonium is strong, the market supply is tight, and the supply exceeds demand. The demand side is well supported. In terms of the market, goods in the market are currently slow, and downstream purchases are mainly in need, and the prices of goods in the market are tight. Overall, the supply of diammonium in the autumn is tight, and diammonium prices are expected to continue to remain high.

Specific market prices in each region are as follows: