- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

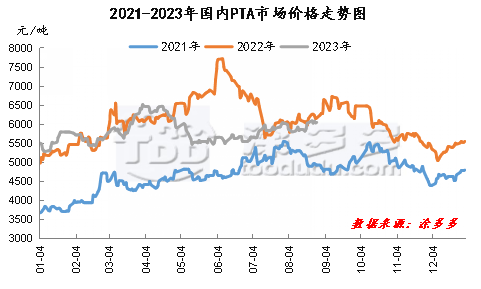

I. the market trend chart of polyester industry chain

On August 29th, the market price index of ethylene glycol was 4028.04, down 4.24 from the previous working day.

China's PTA market price index was 6050 on Aug. 29, up 5% from the previous working day.

On August 29th, the market price index of polyester chips was 6900, which was the same as that of the previous working day. The market price index of polyester bottle chips was 7025, down 50% from the previous working day.

II. Summary of market price of polyester industry chain

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

PTA |

Spot |

East China |

6050 |

6045 |

+5 |

Self-withdrawing tax, yuan / ton |

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

Glycol |

Polyester grade |

East China |

3980 |

3990 |

-10 |

Self-withdrawing tax, yuan / ton |

|

Polyester grade |

South China |

4120 |

4120 |

0 |

Short delivery including tax, yuan / ton |

|

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

Polyester chip |

Semi-light section |

East China |

6900 |

6900 |

0 |

Factory includes tax, yuan / ton |

|

Light slicing |

6920 |

6920 |

0 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

Polyester bottle chip |

Aquarius level (IV.=0.8) |

East China |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

|

Oil bottle grade |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

||

|

Hot pot grade |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

||

|

Carbonic acid grade |

7125 |

7175 |

-50 |

Factory includes tax, yuan / ton |

||

|

Aquarius level (IV.=0.8) |

South China |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

|

|

Oil bottle grade |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

||

|

Hot pot grade |

7025 |

7075 |

-50 |

Factory includes tax, yuan / ton |

||

|

Carbonic acid grade |

7125 |

7175 |

-50 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

Polyester filament |

Jiangsu and Zhejiang market POY150D/48F |

East China |

7700 |

7700 |

0 |

Factory includes tax, yuan / ton |

|

Jiangsu and Zhejiang market FDY150D/96F |

8250 |

8250 |

0 |

Factory includes tax, yuan / ton |

||

|

Jiangsu and Zhejiang market DTY150D/48F |

9125 |

9125 |

0 |

Factory includes tax, yuan / ton |

||

|

Jiangsu and Zhejiang market POY75D/72F |

8050 |

8050 |

0 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.8.29 |

2023.8.28 |

Rise and fall |

Remarks |

|

Polyester staple yarn |

Semi-glossy white 1.56: 38 |

Jiangsu Province |

7480 |

7500 |

-20 |

Factory includes tax, yuan / ton |

|

Semi-glossy white 1.56: 38 |

Zhejiang |

7550 |

7550 |

0 |

Factory includes tax, yuan / ton |

III. Brief introduction of Polyester Industry chain Market

PTA

Today, the spot market of East China PTA is adjusted within a narrow range, and it will be discussed around 6050 yuan / ton. In August, the main port delivery 09 litres of water 15 or 01 litres of water near 50-55 transactions and negotiations. Cost support weakened, PTA futures market fell in a narrow range. The spot supply in the market is loose, traders and suppliers ship normally, downstream rigid demand replenishment is the main, and the market trading atmosphere is general. The short-term market is expected to maintain a narrow range of volatility.

Glycol

Today, the market price of ethylene glycol weakens within a narrow range. The overall sentiment of commodities weakens, the market lacks substantive buying, and the focus of ethylene glycol market negotiations is a narrow pullback. The quotation in East China revolves around 3980 yuan / ton, down 10 yuan / ton from the previous working day. The quotation in South China is around 4120 yuan / ton. International crude oil remains high and cost support remains. East China port high inventory is difficult to alleviate in the short term, while the downstream polyester rigid demand is stable, it is expected that the short-term ethylene glycol market will maintain the finishing pattern.

Polyester chip

Today, the polyester chip market maintains finishing. Polyester raw material PTA market continues to weaken, the cost end support is general, the chip factory offer is stable, the market transaction center of gravity fluctuates slightly, the market low price supply still exists. Downstream rigid demand for stock-based, market trading is low. It is expected that the market price of polyester chips will be narrowly arranged in the short term.

Polyester bottle chip

The market for polyester bottle chips fell narrowly today. Raw material PTA market continues to weaken, lack of cost support, mainstream bottle chip manufacturers offer down 50 yuan / ton, market offer slightly pullback; downstream cautious wait-and-see-based, light market trading. It is expected that the short-term lactone bottle market will maintain the finishing operation.

Polyester filament

Today's polyester filament market deadlock finishing. The cost end support weakens, the market mentality is cautious, the polyester manufacturer more stable market wait and see. Downstream to maintain rigid demand buying, enterprise production and sales continue to be light. It is expected that the market price of filament will be arranged in a narrow range in the short term.

Polyester staple fiber

Today, the market of polyester staple fiber is weak. Polyester raw material market is weak, the price of staple fiber factory is more stable, the shipments of some traders fell in a narrow range, and the supply of high-priced goods in the market declined. The downstream demand continues to be weak, and the rigid demand is mainly for stock. It is expected that the short-term market price of polyester staple fiber will be adjusted slightly.

IV. Polyester Raw material Futures Market

PTA: August 29th PTA main 2401 contract opening price: 6000, lowest price: 5956, highest price: 6040, closing price: 5962, settlement price: 6002, down 42, position: 1612943.

Ethylene glycol: August 29th EG main contract 2401 opening price: 4110, lowest price: 4092, highest price: 4130, closing price: 4096, settlement price: 4113, down 35, position: 390689.

V. production and marketing data of polyester market

|

Product |

2023.8.29 |

2023.8.28 |

Rise and fall |

Unit |

|

Polyester chip |

35% |

40% |

-5% |

% |

|

Polyester filament |

30% |

30% |

0% |

% |

|

Polyester staple fiber |

55% |

50% |

+5% |

% |

VI. Future forecast

International crude oil market high position firm, high cost support, polyester raw material PTA and ethylene glycol market supply and demand side is weak, market lack of continuous drive, short-term market will be narrow adjustment, polyester raw materials to promote the formation of the market, polyester market offer small adjustment, downstream cautious wait-and-see, market production and sales light. Short-term polyester market prices are expected to fluctuate within a narrow range. Pay close attention to the changes of raw material market and demand side in the later stage.