- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: August 28th V2401 contract opening price: 6370, highest price: 6389, lowest price: 6256, position: 650714, settlement price: 6321, yesterday settlement: 6325, down: 4, daily trading volume: 891438 lots, precipitated capital: 2.852 billion, capital outflow: 64.46 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.25 |

Price 8.28 |

Rise and fall |

Remarks |

|

North China |

6180-6220 |

6160-6220 |

-20/0 |

Send to cash remittance |

|

East China |

6200-6260 |

6170-6240 |

-30/-20 |

Cash out of the warehouse |

|

South China |

6250-6350 |

6250-6320 |

0/-30 |

Cash out of the warehouse |

|

Northeast China |

6100-6200 |

6100-6200 |

0/0 |

Send to cash remittance |

|

Central China |

6210-6270 |

6210-6270 |

0/0 |

Send to cash remittance |

|

Southwest |

6000-6150 |

6000-6150 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices weakened, the spot market began to be poor at the beginning of the week. Compared with the valuation, it fell 20 yuan / ton in North China, 20-30 yuan / ton in East China, 30 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. The factory prices of upstream PVC production enterprises have not been significantly adjusted since the beginning of the week, most of which remain stable, but there are few contracts signed on Monday, and there is a strong wait-and-see mood in the spot market. The downward fluctuation of futures is weak, the price offer of traders in the spot market is lower than that of last Friday, and it is difficult to close the deal with one price, and some of them have a small negotiation. After the futures go down, the spot point price has an advantage, and the offer basis changes little. Among them, the base difference offer 01 contract in East China-(50-100), South China 01 contract-(30-70) good powder + 30, North 01 contract-(340-480) Southwest 01 contract-(260). However, whether it is a point price or a mouthful price, the spot trading atmosphere is slightly light, and the terminal purchasing enthusiasm is not good.

Futures point of view: & the nbsp; PVC2401 contract opened high and opened low last Friday night trading, the overall decline in the night trading was not big, and the futures price even shot up in a straight line after the start of the morning trading, but fell at the highest point of 6389. And the iterative afternoon downward range is obvious, the afternoon price is further weaker. 2401 contracts range from 6256 to 6389 throughout the day, with a price difference of 133. 01 contracts reduced their positions by 4866 positions, and so far they have held 650714 positions. The 2309 contract closed at 6185, with 47990 positions.

PVC Future Forecast:

Futures: & the intraday price of the nbsp; PVC2401 contract fell sharply from the high, and the intraday decline significantly recouped some of the previous gains. The technical level shows that the futures price shows a negative column, which is located between the upper tracks in the Bollinger belt (13, 13, 2). The three-track opening means that the opening is flat, and the trading volume shows a certain degree of short opening suppression, of which the blank opening is 24.2% compared with 21.3% more. However, the change in positions throughout the day is not obvious, only a small reduction in positions. The sharp decline in futures prices makes the KD line at the daily line level show a dead cross, and the MACD line also has a dead cross trend. Excessive amplitude leads to a change in the take-up line. In the short term, the rise in futures prices may have come to an end, and there is a probability of back-testing the middle rail to observe the support performance near 6220 near the middle rail.

Spot aspect: At the beginning of the week, the two markets began to weaken, the decline in one price did not lead to an improvement in transactions, and there was more room for single negotiations, even so, the purchasing enthusiasm in the lower reaches was still poor, and the downward range of futures prices was not enough to cause low orders to appear, so the overall spot market performance on Monday was weak, although upstream production enterprises held steady, delaying the downward time of prices. But at present, when commodities rise less or fall more in the afternoon, the market may have the intention of turning. PVC fundamentals, calcium carbide prices are still sporadic upward, but not enough to lead to price changes, the rest of the variables are not many. In the outer disk, the price of the international crude oil futures market continued to rise, due to Marathon A fire at Petroleum's (MPC) refinery in Garyville, Louisiana has heightened concerns about a decline in global refined oil inventories, and oil drilling activity in the United States continues to decline. Overall, the PVC spot market or shock weak performance in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.25 |

8.28 |

Rate of change |

|

V2309 collection |

6355 |

6261 |

-94 |

|

|

Average spot price in East China |

6230 |

6205 |

-25 |

|

|

Average spot price in South China |

6300 |

6285 |

-15 |

|

|

PVC2309 basis difference |

-125 |

-56 |

69 |

|

|

V2401 collection |

6388 |

6297 |

-91 |

|

|

V2309-2401 closed |

-33 |

-36 |

-3 |

|

|

PP2309 collection |

7653 |

7628 |

-25 |

|

|

Plastic L2309 collection |

8399 |

8289 |

-110 |

|

|

V--PP basis difference |

-1298 |

-1367 |

-69 |

|

|

Vmure-L basis difference of plastics |

-2044 |

-2028 |

16 |

|

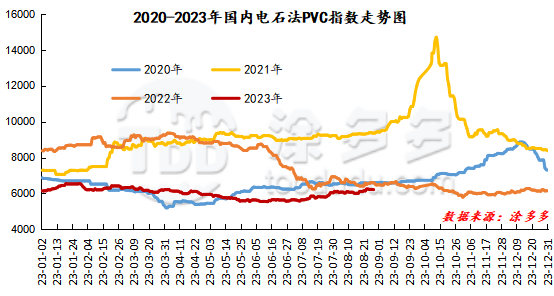

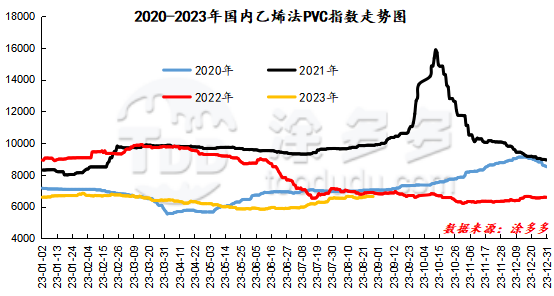

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 12.84 or 0.206% to 6208.82 on Aug. 28. The ethylene PVC spot index was 6630.42, down 7.72, or 0.116%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 421.6.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.25 warehouse orders |

8.28 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

231 |

231 |

0 |

|

|

Zhenjiang Middle and far Sea |

231 |

231 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,074 |

1,074 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,073 |

7,263 |

190 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,124 |

2,124 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,450 |

25,640 |

190 |

|

Total |

|

25,450 |

25,640 |

190 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.

Original: Pei Zhongxue