- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: August 23rd V2401 contract opening price: 6310, highest price: 6391, lowest price: 6310, position: 646200, settlement price: 6352, yesterday settlement: 6247, up: 105, daily trading volume: 891570 lots, precipitated capital: 2.861 billion, capital inflow: 52.69 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.22 |

Price 8.23 |

Rise and fall |

Remarks |

|

North China |

6050-6120 |

6180-6220 |

130/100 |

Send to cash remittance |

|

East China |

6120-6180 |

6230-6280 |

110/100 |

Cash out of the warehouse |

|

South China |

6180-6250 |

6250-6350 |

70/100 |

Cash out of the warehouse |

|

Northeast China |

6000-6100 |

6100-6200 |

100/100 |

Send to cash remittance |

|

Central China |

6130-6170 |

6240-6300 |

110/130 |

Send to cash remittance |

|

Southwest |

5990-6150 |

6090-6250 |

100/100 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue to rise, the spot market tends to be strong. Compared with the valuation, it rose 100-130 yuan / ton in North China, 100-110 yuan / ton in East China, 70-100 yuan / ton in South China, 100 yuan / ton in Northeast China, 110-130 yuan / ton in Central China, and 100 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises generally increase by 100-120 yuan / ton, individual increases by 50 yuan / ton, the price adjustment of production enterprises is relatively unified and the range is larger. After the futures price surpassed the previous high, the price offer of traders in the spot market in the morning was higher than that of yesterday, and the basis of the point price did not change much, but there was not much transaction under the high price for the time being, and there was no price advantage in the supply of spot price after the futures price went up. Ethylene production enterprises and traders also raised their quotations at the same time. On the whole, the spot market sentiment has improved, and the supply of some brands is tight and the price is slightly higher. However, the overall downstream procurement enthusiasm is not high, wait-and-see intention is obvious, relatively contradict high prices, the spot market trading atmosphere is weak.

Futures point of view: PVC2401 contract night futures prices rose strongly high, once surpassed the main line before the high, but then the high price has fallen. After the start of morning trading, the futures price opened a long high concussion pattern throughout the day, and the afternoon price still runs in a narrow range until the end. 2401 contracts fluctuate in the range of 6310-6391 throughout the day, with a spread of 81. 01. The contract increased its position by 7763 hands, with 646200 positions so far. The 2309 contract closed at 6255, with 78329 positions.

PVC Future Forecast:

Futures: The futures price of PVC2401 contract showed an obvious high upward trend, surpassing the previous high of 01 contract by 6372 and refreshing to a new high of 6391. The rapid upward trend of futures price was still caused by long opening, which was 23.8% higher than that of short opening, and the futures price rose through the upper track position of the Bollinger belt (13, 13, 2), but the high price was suppressed by the entry of empty orders. And the futures price before the high retail investors after a single profit-taking, the same day there was a multi-flat phenomenon. The technical level shows that the daily KD line shows a golden fork trend, the MACD turns to the golden fork, and the opening of the third rail of the Bollinger belt opens, but there is pressure and a certain empty force in the upper rail direction. Continue to observe the performance near the pressure level 6360 in the short term.

Spot: futures prices in the two markets rose strongly and adjusted by a large extent, and spot prices were also driven by futures prices, both production enterprises and traders rose sharply, but there was an obvious wait-and-see mood in the lower reaches of the real order under high prices. We have repeatedly mentioned in our previous point of view that there are still strong expectations in the third quarter, but according to the current upward trend, expectations are realized ahead of schedule or tend to consider gold, silver and silver. In the medium and long term, whether from the landing of the policy port or from foreign economic concerns, conflicts may break out in the fourth quarter if weak data cannot support expectations. In the short term, it is rumored in the spot market that the quotation of Yue driving products in Southeast Asia CFR is about US $820. the price of calcium carbide in other PVC fundamentals continues to rise, which forms a certain supporting role to the cost port. The rest of the level is not new, the overall commodity sentiment is strong at present, the spot price of PVC may continue to be high in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.22 |

8.23 |

Rate of change |

|

V2309 collection |

6284 |

6325 |

41 |

|

|

Average spot price in East China |

6150 |

6255 |

105 |

|

|

Average spot price in South China |

6215 |

6300 |

85 |

|

|

PVC2309 basis difference |

-134 |

-70 |

64 |

|

|

V2401 collection |

6312 |

6357 |

45 |

|

|

V2309-2401 closed |

-28 |

-32 |

-4 |

|

|

PP2309 collection |

7660 |

7645 |

-15 |

|

|

Plastic L2309 collection |

8384 |

8376 |

-8 |

|

|

V--PP basis difference |

-1376 |

-1320 |

56 |

|

|

Vmure-L basis difference of plastics |

-2100 |

-2051 |

49 |

|

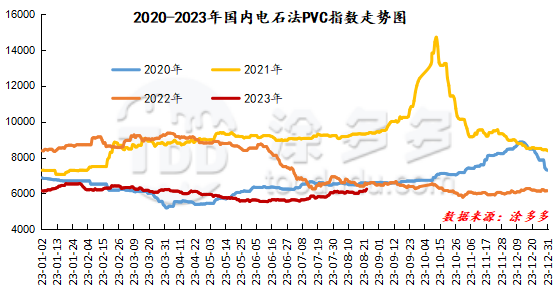

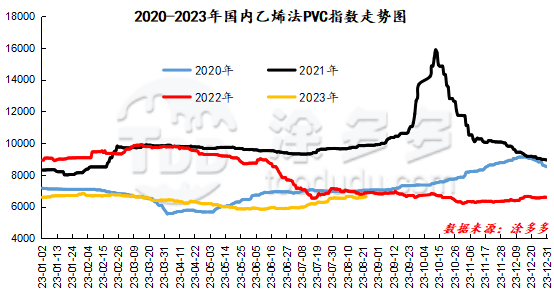

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 103.75, or 1.69%, to 6241.32 on Aug. 23. The ethylene PVC spot index was 6618.24, up 19.95, or 0.287%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 376.92.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.22 warehouse orders |

8.23 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

231 |

231 |

0 |

|

|

Zhenjiang Middle and far Sea |

231 |

231 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,074 |

1,074 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,168 |

6,168 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,324 |

-143 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

24,888 |

24,745 |

-143 |

|

Total |

|

24,888 |

24,745 |

-143 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.