- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

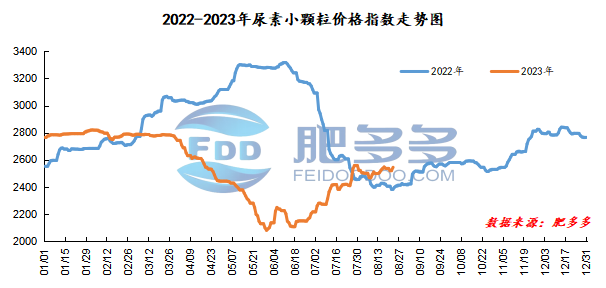

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 23 was 2,544.68, up 22.59 from yesterday, up 0.9% month-on-month, and up 6.67% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2145, the highest price: 2269, the lowest price: 2136, the settlement price: 2238, the closing price: 2269, the closing price increased by 149 compared with the settlement price of the previous trading day, and the month-on-month increase by 7.03%. The daily fluctuation range is 2136-2269, and the spread is 133; the 01 contract has increased its position by 24683 lots today, and has held 355903 lots so far.

Spot market analysis:

Today, the price of urea in China has increased significantly, with an increase of 20-150 yuan/ton. The main reason for this round of increase is Jincheng's production restriction and good supply support.

Specifically, prices in Northeast China rose to 2,400 - 2,480 yuan/ton. Prices in North China rose to 2,400 - 2,590 yuan/ton. Prices in the northwest region are stable at 2,510 - 2,520 yuan/ton. Prices in Southwest China rose to 2,450 - 2,800 yuan/ton. Prices in East China rose to 2,520 - 2,600 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,500 - 2,680 yuan/ton, and the price of large particles has stabilized at 2,480 - 2,550 yuan/ton. Prices in South China have stabilized at 2,600 - 2,680 yuan/ton.

Market outlook forecast:

In terms of supply, Shanxi Jincheng has limited production for one week due to environmental factors. Although there will be a small number of companies resuming work and production in the next week, Jincheng is the main area for urea production. This production restriction in Jincheng will lead to a decline in urea market supply and tight market spot. On the demand side, there is currently certain demand in the agricultural market to follow up, and domestic demand is expected to increase. In addition, compound fertilizer factories and export orders are also following up in an orderly manner. Some urea factories have better orders, and companies have taken the trend to increase their ex-factory quotations. In addition, there are rumors in the market that related to the printing of bids, which has disturbed the sentiment of the futures and spot market. However, the next bidding time is still early and there are large uncertainties. After the coal mine accident in Shaanxi, coal prices rebounded slightly.

On the whole, the current increase in domestic demand in the urea market and the increase in export demand, coupled with the decline in daily output in the short term, has led to a decrease in corporate inventories and the market exceeds demand. The urea market is expected to show an upward trend in the short term.