- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: August 22nd V2401 contract opening price: 6272, highest price: 6285, lowest price: 6212, position: 638437, settlement price: 6247, yesterday settlement: 6249, down: 2, daily trading volume: 679216 lots, precipitated capital: 2.808 billion, capital inflow: 149 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.21 |

Price 8.22 |

Rise and fall |

Remarks |

|

North China |

6050-6120 |

6050-6120 |

0/0 |

Send to cash remittance |

|

East China |

6150-6190 |

6120-6180 |

-30/-10 |

Cash out of the warehouse |

|

South China |

6180-6270 |

6180-6250 |

0/-20 |

Cash out of the warehouse |

|

Northeast China |

6000-6100 |

6000-6100 |

0/0 |

Send to cash remittance |

|

Central China |

6130-6170 |

6130-6170 |

0/0 |

Send to cash remittance |

|

Southwest |

5990-6150 |

5990-6150 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, general trading atmosphere. The comparison of valuation shows that North China is stable, East China is down 10-30 yuan / ton, South China is down 20 yuan / ton, and Northeast, Central China and Southwest China are stable. Most of the factory prices of upstream PVC production enterprises remain stable, and there is no obvious adjustment. Although there are few contracts signed in the first generation on Tuesday, the futures price performance is weaker, but the price is still hovering at a high level. The price range of traders in various regions is mainly arranged in a narrow range, and the price offer in some areas is slightly lower than that of yesterday, and the high price is generally difficult to negotiate in a small part. Compared with the one-mouth price point, there is an advantage after the futures price goes down. Among them, East China base offer 01 contract-(50-100), South China 01 contract-(20-70) good fan + (0-30), North 01 contract-(330-480), Southwest 01 contract-(200-260). On the whole, the purchasing enthusiasm of the downstream is not high, the wait-and-see intention is obvious, and the trading atmosphere in the spot market is weak.

From the perspective of futures: & the night price of nbsp; PVC2401 contract is high and low, and the night market is relatively down. After the start of morning trading, futures bottomed out after reaching a low of 6212. Futures prices returned to the upward trend, but the high did not break yesterday's high, afternoon prices in a narrow range of finishing late trading continued to pull up. 2401 contracts range from 6212 to 6285 throughout the day, with a spread of 73. 01 contracts with an increase of 33389 positions and 638437 positions so far. The 2309 contract closed at 6219, with 101503 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices show a V-shaped trend, futures prices fall first and then rise, and the market is still bullish. From the trading trend, the opening is 26.7% higher than the short opening 23.5%. On the one hand, the long position to change the month, 09 contract is about to end, on the other hand, retail investors are much shorter. The technical level shows that the opening of the Bollinger belt (13, 13, 2) opens, the candle picture shows a positive pillar and shows a certain upward force. The daily KD line shows a golden fork trend, and the MACD dead fork trend narrows to a golden fork. We still maintain the previous view that there is still a strong trend in futures prices, but the range may be limited, and we will continue to observe the performance below the pressure level 6330.

Spot: & the continuous improvement of the two cities in the nbsp; period has not been continued today, but there is no weakness is still mainly adjusted within a narrow range. However, the spot market traders feedback that the downstream wait-and-see mood is strong, the transaction is relatively difficult under the high price, and the point price is also light, and the lower reaches tend to low replenishment. At present, there are not many fundamental variables in PVC, the start-up is stable, the demand is also like the early stage, and the change of social inventory is not obvious. In the outer disk, prices in the international crude oil futures market fell slightly on the back of renewed concerns about the global economy and the outlook for global oil demand against a backdrop of high interest rates from central banks in Europe and the United States, and the recent rise in oil prices could encourage Saudi Arabia to slow down the pace of production cuts. Markets are waiting for the Fed chairman's speech at the annual meeting of the central bank in Jackson Hole on Friday. the Fed is widely expected to keep interest rates high for longer, with 10-year Treasury yields hitting their highest level since 2007 to dampen risk appetite. On the whole, PVC is relatively sensitive to policy feedback in the third quarter, and it will still be high and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.21 |

8.22 |

Rate of change |

|

V2309 collection |

6278 |

6284 |

6 |

|

|

Average spot price in East China |

6170 |

6150 |

-20 |

|

|

Average spot price in South China |

6225 |

6215 |

-10 |

|

|

PVC2309 basis difference |

-108 |

-134 |

-26 |

|

|

V2401 collection |

6310 |

6312 |

2 |

|

|

V2309-2401 closed |

-32 |

-28 |

4 |

|

|

PP2309 collection |

7630 |

7660 |

30 |

|

|

Plastic L2309 collection |

8352 |

8384 |

32 |

|

|

V--PP basis difference |

-1352 |

-1376 |

-24 |

|

|

Vmure-L basis difference of plastics |

-2074 |

-2100 |

-26 |

|

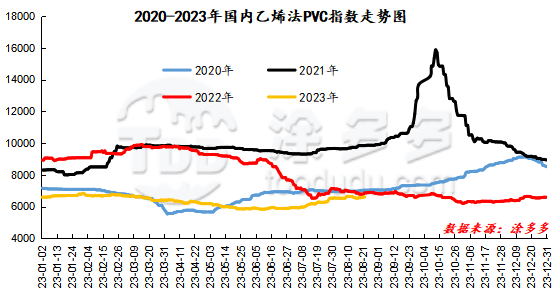

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 8.17% to 6137.57, or 0.133% on Aug. 22. The PVC spot index of ethylene method is 6599.29, up 0%, the range of 0%, the index of calcium carbide method is down, the index of ethylene method is stable, and the price difference between ethylene method and calcium carbide method is 461.72.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.21 warehouse receipts |

8.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

231 |

231 |

0 |

|

|

Zhenjiang Middle and far Sea |

231 |

231 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,374 |

1,074 |

-300 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,168 |

6,168 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,031 |

1,531 |

-500 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,688 |

24,888 |

-800 |

|

Total |

|

25,688 |

24,888 |

-800 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.