- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

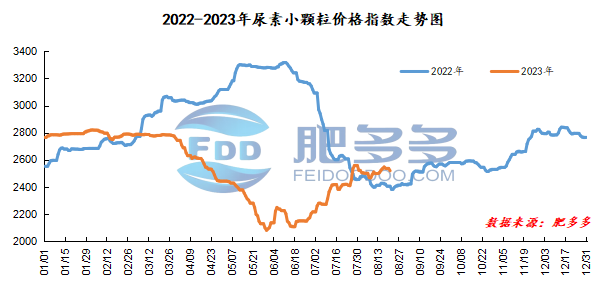

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 21 was 2,519.14, down 17.27 from last Friday, down 0.68% month-on-month, and up 4.75% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2065, the highest price: 2187, the lowest price: 2065, the settlement price: 2135, the closing price: 2162. The closing price increased by 66 compared with the settlement price of the previous trading day, and the month-on-month increase by 3.15%. The daily fluctuation range is 2065-2187, and the spread is 122; the 01 contract has increased its positions by 11741 lots today, and so far, it has held 343846 lots.

Spot market analysis:

Today, China's urea market price showed a downward trend. Affected by Indian bidding in the early stage, the Chinese market price rose to a high level, and market resistance began to appear.

Specifically, prices in Northeast China have stabilized at 2,240 - 2,460 yuan/ton. Prices in North China fell to 2,350 - 2,600 yuan/ton. Prices in the northwest region are stable at 2,590 - 2,600 yuan/ton. Prices in Southwest China are stable at 2,400 - 2,700 yuan/ton. Prices in East China fell to 2,500 - 2,580 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,450 - 2,680 yuan/ton, and the price of large particles fell to 2,480 - 2,550 yuan/ton. Prices in South China fell to 2,600 - 2,680 yuan/ton.

Market outlook forecast:

On the enterprise side, companies have recently overhauled their equipment, and the daily output is relatively low. The supply side is good, which has certain support for market prices. However, due to the impact of the continued high rise in market prices in the early period, fear of high prices in the downstream market began to appear, and purchases were cautious, and transaction orders were relatively reduced. In terms of exports, judging from the results released by India, most of the urea will be imported from China. For foreign markets, China's export volume far exceeds expectations, and export demand is good. China's urea has limited room for shock. Recently, international urea prices have begun to show a downward trend.

On the whole, there is still certain positive support in the market. China's urea market prices are expected to remain volatile. The specific situation still needs to pay attention to the purchasing sentiment of Chinese factories and the price trend in foreign markets.