- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: August 15 V2309 contract opening price: 6059, highest price: 6092, lowest price: 6025, position: 355808, settlement price: 6056, yesterday settlement: 6083, down: 27, daily trading volume: 472710 lots, precipitated capital: 1.515 billion, capital outflow: 208 million.

V2401 contract opening price: 6090, highest price: 6130, lowest price: 6065, position: 462282, settlement price: 6097, yesterday settlement: 6137, down: 40, daily trading volume: 366818 lots, precipitated capital: 1.98 billion, capital inflow: 172 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.14 |

Price 8.15 |

Rise and fall |

Remarks |

|

North China |

5920-6030 |

5920-6010 |

0/-20 |

Send to cash remittance |

|

East China |

5970-6000 |

5950-6000 |

-20/0 |

Cash out of the warehouse |

|

South China |

6090-6180 |

6050-6160 |

-40/-20 |

Cash out of the warehouse |

|

Northeast China |

5900-6050 |

5900-6000 |

0/-50 |

Send to cash remittance |

|

Central China |

5970-6070 |

5970-6070 |

0/0 |

Send to cash remittance |

|

Southwest |

5850-6000 |

5840-6000 |

-10/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, some areas slightly lower center of gravity. Compared with the valuation, it fell 20 yuan / ton in North China, 20 yuan / ton in East China, 20-40 yuan / ton in South China, 50 yuan / ton in Northeast China, stable in Central China and 10 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises fell by 50 yuan / ton, and some enterprises continued to wait and see for stable prices. The participation of production enterprises in this price adjustment is insufficient. Futures prices fell first and then rose, so the trend of the spot market throughout the day was slightly divergent, with a lower price offer in the morning than yesterday, and the point price supply part had a price advantage. Among them, East China base offer 01 contract-(30-80), South China 01 contract-(0-50) good fans + (20-50), North 01 contract-(350-450), Southwest 01 contract-(200). Afternoon prices rebounded and some traders adjusted to recover the decline, but the overall feedback spot inquiry enthusiasm is not high, the downstream part of the temporary wait-and-see, spot market trading atmosphere is weak.

Futures point of view: PVC2401 contract night futures prices fluctuated in a narrow range, the intraday trend is not obvious. At the beginning of early trading, prices did not see large fluctuations, still dominated by shocks, but intraday prices fell, afternoon prices reversed, from falling to rising. 2401 contracts range from 6065 to 6130 throughout the day, with a spread of 65. 01 contracts with an increase of 38724 positions and 462282 positions so far. The 2309 contract closed at 6083, with 355808 positions.

PVC Future Forecast:

Futures: & the nbsp; PVC2401 contract price runs in a narrow range, showing a trend of significantly increasing the position by 38724 hands, but there is a differentiation throughout the day from the point of view of the transaction. The downward short opening of the futures price in the morning is relatively obvious, but the afternoon price reverses and then enters the market. Among them, the whole day showed 25.0% more than 25.0% empty 25.8% equal. The candle picture shows the positive pillar but the low price pierces the lower rail position, and the technical level shows that the opening of the Bollinger belt (13, 13, 2) three tracks is open. But line-level KD and MACD trends are still not good. For the short-and medium-term point of view, we believe that the 09 contract will not perform much before the end of the contract. The new 01 contract is still expected to rise to a certain extent in the medium term. In the short term, we believe that the 01 contract will continue to operate with low winding and narrow band.

Spot aspect: the frequent adjustment of prices in the two markets, but the current range is narrowing and the price rise and fall is not obvious for the market stimulus feedback. Real estate data released from January to July, national investment in real estate development fell 8.5% from a year earlier, and housing construction area of real estate development enterprises fell 6.8% from the same period last year. Real estate data continued to be weak, did not have too much impact on the market, although there is a decline in current prices, but to a smaller extent. A reversal in the afternoon market. The central bank "cut interest rates" twice a day! Cut the SLF interest rate by 10 basis points. In addition, on August 15, the central bank launched 204 billion yuan of open market reverse repurchase operations and 401 billion yuan of medium-term loan facility (MLF) operations. PVC fundamental variables are still few, calcium carbide prices continue to rise sporadically, cost port support is obvious. But at present, the price trend of the two cities is less affected by fundamentals, we continue to maintain the previous point of view, the adjustment of PVC spot prices in the short term is still relatively volatile in a small range.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.14 |

8.15 |

Rate of change |

|

V2309 collection |

6045 |

6083 |

38 |

|

|

Average spot price in East China |

5985 |

5975 |

-10 |

|

|

Average spot price in South China |

6135 |

6105 |

-30 |

|

|

PVC2309 basis difference |

-60 |

-108 |

-48 |

|

|

V2401 collection |

6099 |

6119 |

20 |

|

|

V2309-2401 closed |

-54 |

-36 |

18 |

|

|

PP2309 collection |

7376 |

7418 |

42 |

|

|

Plastic L2309 collection |

8096 |

8116 |

20 |

|

|

V--PP basis difference |

-1331 |

-1335 |

-4 |

|

|

Vmure-L basis difference of plastics |

-2051 |

-2033 |

18 |

|

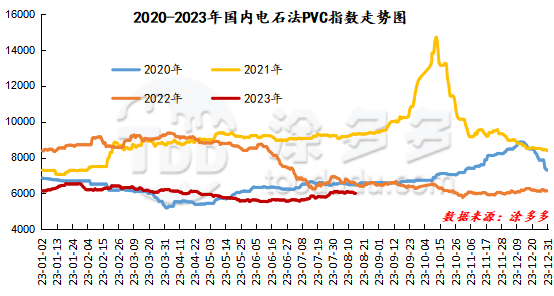

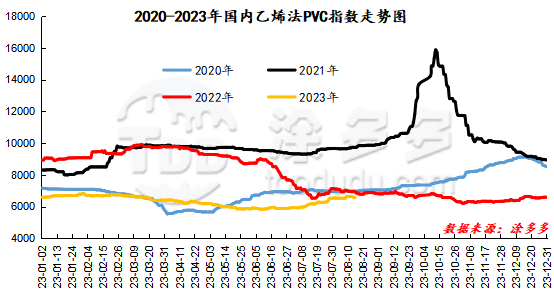

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index fell 13.66% to 6000.67 on August 15, down 0.227%. The ethylene PVC spot index was 6555.18, down 19.65, or 0.299%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 554.51.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.14 warehouse orders |

8.15 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,180 |

1,180 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,156 |

6,156 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,031 |

2,031 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,251 |

25,251 |

0 |

|

Total |

|

25,251 |

25,251 |

0 |

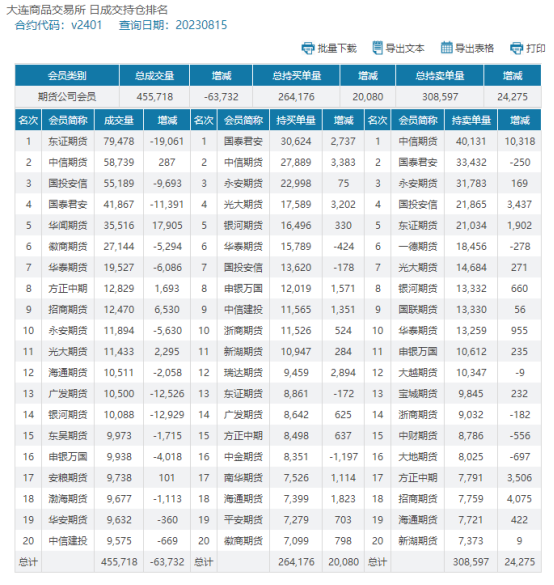

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.