- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: August 7 V2309 contract opening price: 6187, highest price: 6187, lowest price: 6105, position: 505444, settlement price: 6136, yesterday settlement: 6199, down: 63, daily trading volume: 645702 lots, precipitated capital: 2.176 billion, capital outflow: 131 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.4 |

Price 8.7 |

Rise and fall |

Remarks |

|

North China |

5990-6100 |

5940-6070 |

-50/-30 |

Send to cash remittance |

|

East China |

6020-6120 |

5980-6030 |

-40/-90 |

Cash out of the warehouse |

|

South China |

6130-6200 |

6050-6180 |

-80/-20 |

Cash out of the warehouse |

|

Northeast China |

5900-6100 |

5900-6050 |

0/-50 |

Send to cash remittance |

|

Central China |

6010-6070 |

5980-6040 |

-30/-30 |

Send to cash remittance |

|

Southwest |

5900-6050 |

5850-6000 |

-50/-50 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market began to shift downward at the beginning of the week, and prices fell slightly. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 40-90 yuan / ton in East China, 20-80 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises has been reduced by 30-50 yuan per ton, and some enterprises have maintained stability. The intraday futures were obviously weaker, and the quoted prices of traders in various regions were slightly lower than last Friday, but after the futures price went down, the point price had a price advantage, and the basis offer changed little, and most traders turned to 01 contract. Among them, East China basis offer 01 contract-(150-170), South China 01 contract-(Pingshui-30-60), North 01 contract-(420-450) Southwest 01 contract-(200-280). However, even the overall transaction of the price downward spot market is also slightly general, the terminal rigid demand replenishment inquiry enthusiasm is not good, the purchase is weak, the single price is on the high side, it is difficult to close the transaction.

From a futures point of view: & the opening price of the nbsp; PVC2309 contract rose at night, but by a small margin and then lowered. After the start of morning trading, futures prices rose straight to the highest point of 6236 and then weakened, but the decline was small, and afternoon prices fell slightly in late afternoon trading. 2309 contracts range from 6162 to 6236 throughout the day, with a price difference of 74. 09 contracts reduced by 20863 positions and 532514 positions so far. The 2401 contract closed at 6235, with 274446 positions.

PVC Future Forecast:

Futures: & the operation of the futures price of the nbsp; PVC09 contract shows an obvious market of changing positions and changing months. First of all, 09-01 contracts show a small discount, that is, 01 contract prices higher than 09 contracts are more conducive to short positions. From the point of view of position increase or decrease, 09 contracts reduced positions 27071 hands 01 contracts increased positions 20713 hands echoed. However, due to the narrow fluctuation of the market price, the lack of guidance from fundamentals and policy aspects is considered. The technical level shows that the 09 contract price shows a certain support in the middle track position, the opening of the three tracks of the Bollinger belt (13,13,2) narrows, and the daily KD line and MACD show a dead fork trend. On the whole, the operation of the futures price in the short term is facing some pressure, but the narrow winding mode may continue, continue to observe the performance of 09 support 6075 near 01 support 6110.

Spot: & the high opening and low price of nbsp; futures led to the spot market prices began to decline at the beginning of the week, and the price decline did not lead to an improvement in transactions, although the spot price has advantages, but traders feedback shipments are still poor. First of all, the fundamentals of PVC, some businesses still focus on the performance of export data and expectations of Formosa Plastics quotations. In addition, most of the real estate stocks suffered a setback, and Chinese real estate data were released in the middle of the year, but they are still not expected to perform well. The weak real estate data has a greater restraining effect on PVC. However, in terms of Chinese policy, there is still no more guiding direction, so the current two markets have entered the stage of narrow arrangement after the expected completion of the transaction. At present, the trend of differentiation begins to appear between the plates, in which the black plate, especially the double coke spot, has an upward trend due to weather and transportation reasons, but the plasticizing plate has shown some signs of weakness. On the whole, the spot price of PVC or narrow range operation is mainly arranged in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.4 |

8.7 days |

Rate of change |

|

V2309 collection |

6187 |

6149 |

-38 |

|

|

Average spot price in East China |

6070 |

6005 |

-65 |

|

|

Average spot price in South China |

6165 |

6115 |

-50 |

|

|

PVC2309 basis difference |

-117 |

-144 |

-27 |

|

|

V2401 collection |

6235 |

6191 |

-44 |

|

|

V2309-2401 closed |

-48 |

-42 |

6 |

|

|

PP2309 collection |

7416 |

7392 |

-24 |

|

|

Plastic L2309 collection |

8206 |

8164 |

-42 |

|

|

V--PP basis difference |

-1229 |

-1243 |

-14 |

|

|

Vmure-L basis difference of plastics |

-2019 |

-2015 |

4 |

|

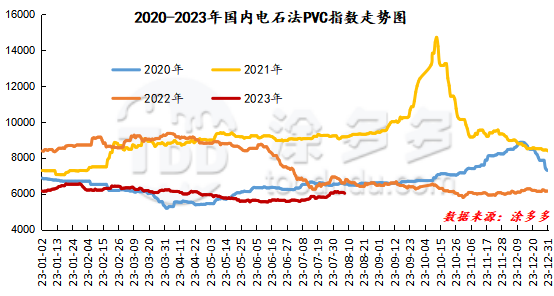

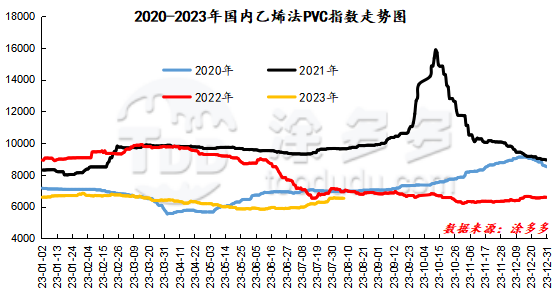

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 48.41, or 0.798%, to 6020.87 on Aug. 7. The ethylene method PVC spot index was 6520.73, down 5.55%, with a range of 0.085%. The calcium carbide method index fell, the ethylene method index dropped, and the ethylene-calcium carbide index spread was 499.86.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.4 warehouse orders |

8.7 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

360 |

360 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,162 |

2,162 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

768 |

768 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

2,767 |

3,393 |

626 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,521 |

1,521 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

0 |

120 |

120 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,854 |

1,854 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,302 |

1,302 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

260 |

260 |

0 |

|

PVC subtotal |

|

18,478 |

19,224 |

746 |

|

Total |

|

18,478 |

19,224 |

746 |

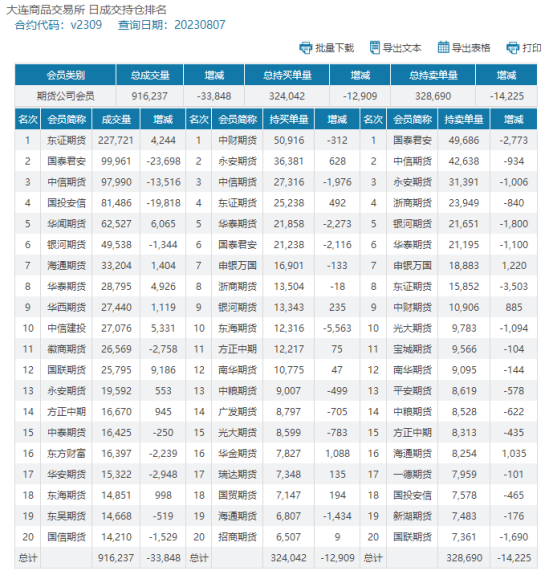

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.