- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

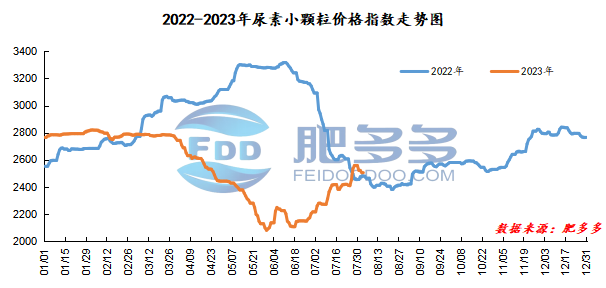

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 3 was 2,500.91, down 4.09 from yesterday, down 0.16% month-on-month, and up 0.83% year-on-year.

Urea futures market:

The opening price of the Urea UR2309 contract: 2240, the highest price: 2291, the lowest price: 2211, the settlement price: 2252, and the closing price: 2254. The closing price dropped 82 compared with the settlement price of the previous trading day, and the month-on-month decline was 3.51%. The daily fluctuation range was 2211-2291, and the spread was 80; The 09 contract reduced its position by 17812 lots today, and the position held so far was 201699 lots.

Spot market analysis:

Today, the price of urea in China's market has stabilized and declined. The price has risen to a high level in the previous period. The market has high resistance, mainly due to the need for replenishment. In addition, the impact of negative export news has been negative for the trend of urea prices.

Specifically, prices in Northeast China have stabilized at 2,230 - 2,450 yuan/ton. Prices in North China fell by 20 to 2,280 - 2,590 yuan/ton. Prices in the northwest region are stable at 2,510 - 2,520 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,700 yuan/ton. Prices in East China have stabilized at 2,470 - 2,550 yuan/ton. The price of small and medium-sized particles in Central China fell by 20 to 2,470 - 2,700 yuan/ton, and the price of large particles fell by 10 to 2,550 - 2,630 yuan/ton. Prices in South China fell by 20 to 2,600 - 2,700 yuan/ton.

Market outlook forecast:

It is expected that urea starts will increase next week, which will have a negative impact on supply; downstream demand, China's agriculture is currently entering a slack period. Agriculture is in the off-season of fertilization, and urea use is declining; companies are implementing more early export orders, and inventories are not high. Internationally, the tender for imported urea issued by India has not yet been implemented, and there is still great uncertainty in the tender. Most people hold a wait-and-see attitude, and it is expected that the next announcement of the printed bid price will have a greater impact on the Chinese market. In terms of futures, the trading price of urea futures weakened. It is expected that the slight decline in futures prices in this round will affect the simultaneous decline in urea market prices.

On the whole, the current supply of urea in the market is increasing, and demand generally affects the weakening of prices. However, at present, corporate inventories are not high to support, and the weakening of prices is limited. At the same time, we need to wait for the implementation of the stamp label.