- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

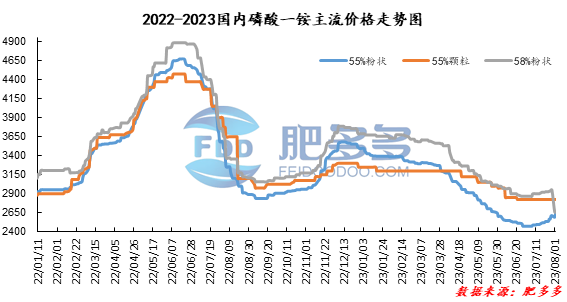

Monoammonium phosphate price index:

According to Feiduo data, on August 1, the 55% powder index of China's monoammonium phosphate was 2,642.86, rising; the 55% particle index was 2,825.00, stable; the 58% powder index was 2650, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market has risen across the board, mainly due to the increase in the price of 55 powder, with the adjustment range of 50-100 yuan/ton. Quotations for 55 granules and 58 powder have stopped in various places, and factories have mainly issued orders for 55 powder. In terms of raw materials, the price of synthetic ammonia is still rising sharply, and the price of sulfur is also rising in some regions, making cost support stronger and stronger. Supported by cost boost and the large amount of support accumulated last week, as well as the continuous follow-up of downstream demand, the atmosphere for rising prices was strong. It is reported that the international price of ammonium monoamine is also on an upward trend. Now that new market prices have been introduced, the downstream mentality of buying up rather than buying down is frequent, and high-priced transactions are gradually increasing. On the whole, the monoammonium industry may experience supply shortages, and some units may be put into production again. It is expected that the price of monoammonium in the market will remain firm and upward during the week.

Specific market prices in each region are as follows:

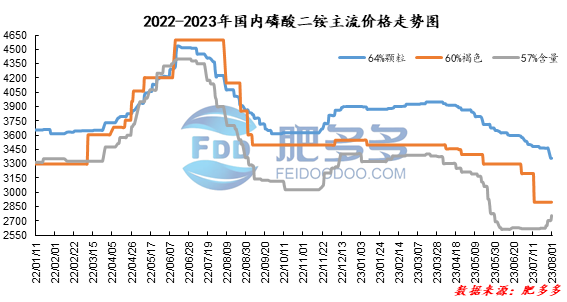

Diammonium phosphate price index:

According to Feiduo data, on August 1, the 64% particle index of China's mainstream diammonium phosphate was 3,360.00, stable; the 60% brown index was 2,900.00, stable; and the 57% content index was 2,752.50, rising.

Diammonium phosphate market analysis and forecast:

Today, the mainstream prices in China's diammonium phosphate market increased sporadically, with an increase of 30-80 yuan/ton. Internationally, the bid price of diammonium in Bangladesh exceeded expectations, boosting the Chinese market on an emotional basis. Although downstream demand is currently slow to follow up, orders for diammonium can last for more than one month. Some companies have stopped quoting and acquiring orders, mainly shipping orders received in advance. At present, there is a tight supply of goods and shipments on site, and there is still room for improvement in the industry's start-up. Compound fertilizer companies still have just needed it, and the market has shown positive results this week. Therefore, they believe that there is no need to worry about the demand for diammonium in the later market. Overall, the diammonium market may continue to consolidate in the short term, with prices rising sporadically in some regions.

Specific market prices in each region are as follows: