- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

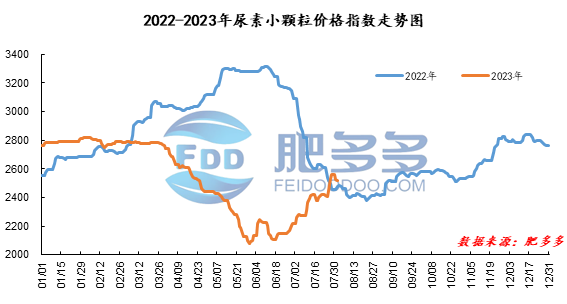

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 1 was 2,519.09, down 3.18 from yesterday, down 0.13% month-on-month, and up 1.78% year-on-year.

Urea futures market:

The price of the urea UR2309 contract rose rapidly and slightly after the opening of early trading today, and fell to the intraday low of 2296, before fluctuating upward again. In the afternoon, the futures price continued to rise, rising to the intraday high of 2368, and then fell within a narrow range, closing at 2354 at the end. The opening price of the Urea UR2309 contract: 2305, the highest price: 2368, the lowest price: 2296, the settlement price: 2331, the closing price: 2354. The closing price increased by 37 compared with the settlement price of the previous trading day, and the month-on-month increase by 1.60%. The daily fluctuation range is 2296-2368, and the spread is 72; The 09 contract has increased its positions by 420 lots today, and so far, it has held 235950 lots.

Spot market analysis:

The spot market price of urea in China continued to decline slightly today, with quotes in most regions falling by 20-120 yuan/ton. Transactions in China have decreased significantly, and exports have also temporarily slowed down and stalled. Coupled with the weather affecting transportation in some regions, manufacturers are facing pressure from shipments and inventory, so some obvious loosening has promoted new orders. Specifically, prices in Northeast China rose to 2,250 - 2,430 yuan/ton. Prices in North China fell to 2,280 - 2,610 yuan/ton. Prices in Northwest China fell to 2,510 - 2,520 yuan/ton. Prices in Southwest China are stable at 2,450 - 3,000 yuan/ton. Prices in East China fell to 2,480 - 2,530 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,490 - 2,700 yuan/ton, and the price of large particles fell to 2,570 - 2,630 yuan/ton. Prices in South China fell to 2,650 - 2,720 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures prices were mainly volatile and did not provide strong guidance for spot goods. Fundamentally speaking, in terms of supply, the current industry start-ups remain at more than 80%, and the daily output is above 170,000 tons. In the short term, the number of new orders from factories will decrease, and supply pressure may gradually emerge. On the demand side, agricultural demand has entered a seasonal gap, and downstream inquiries have become increasingly rare. Although mainstream quotations in various places have been adjusted downward to promote orders acquisition, the effect is not yet obvious. Downstream compound fertilizer factories and plywood factories are still in need of replenishment, and overall demand is weakening. Yesterday, we mentioned that prices in the two markets were heading towards high levels in the last cycle, and the price and trading volume of printed labels were called the key factors determining the trend of China's market. The emotional aspect is only a short-term impact. In the end, it is still market supply and demand that affect the market. Due to the temporary uncertainty of positive market conditions in recent days, it is expected that the urea market will be weak and mainly downward in the short term.