- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

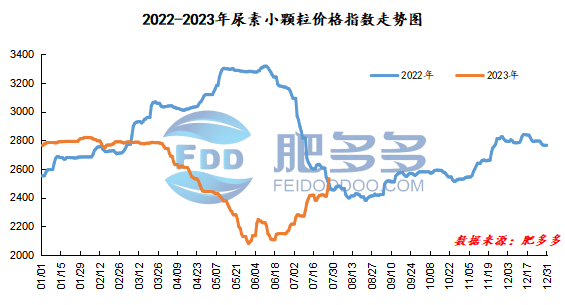

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 27 was 2,532.73, up 81.68 from yesterday, up 3.33% month-on-month, and up 1.42% year-on-year.

Urea futures market:

The price of the urea UR2309 contract rose first and then fell today. The price first fluctuated to a low of 2315 in early trading and later on, and then continued to rise, hitting the intraday high of 2419 before noon. In the afternoon, the futures price adjusted back and closed at 2366 in late trading. The opening price of the Urea UR2309 contract: 2340, the highest price: 2419, the lowest price: 2315, the settlement price: 2368, and the closing price: 2366. The closing price increased by 64 compared with the settlement price of the previous trading day, and the month-on-month increase by 2.78%. The daily fluctuation range is 2315-2419, and the spread is 104; The 09 contract has reduced its position by 33841 lots today, and its position so far has been held by 260054 lots.

Spot market analysis:

Today, China's urea spot market prices rose sharply again during the week, with price increases ranging from 60 to 250 yuan/ton in various regions. The market supply and demand situation has not changed much. Spot supply is loose. Agricultural demand on the demand side is gradually entering a blank period. Demand for the compound fertilizer industry is not likely to be released in large quantities until late August. Demand for melamine and plywood has also remained weak. Looking at the terminal, it has just slowed down. The rapid increase in prices in the short term was mainly driven by seals and futures. Specifically, prices in Northeast China rose to 2,260 - 2,320 yuan/ton. Prices in North China rose to 2,320 - 2,650 yuan/ton. Prices in Northwest China rose to 2,610 - 2,620 yuan/ton. Prices in Southwest China are stable at 2,350 - 3,000 yuan/ton. Prices in East China rose to 2,540 - 2,600 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,540 - 2,650 yuan/ton, and the price of large particles rose to 2,540 - 2,580 yuan/ton. Prices in South China rose to 2,700 - 2,730 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices continued to rise today, effectively driving spot sentiment and pushing up the market. Fundamentally speaking, the supply side industry has maintained a high level of start-ups. Some units have been stopped for a short period of time, accompanied by the recovery of some units, and the daily output has returned to about 170,000 tons. In the long run, some enterprises in Shanxi and Inner Mongolia had maintenance plans in August, but the factory's mood is high now and the possibility of postponing the maintenance plan is not ruled out. In terms of demand, agricultural demand is gradually moving towards the off-season, with conservatively speaking a gap of about one month. Short-term agricultural demand is difficult to be optimistic; in terms of labor demand, downstream compound fertilizer factories and plywood factories maintain appropriate replenishment, and overall demand is weakening. Internationally, the rise in global grain prices during the week led to an increase in the international price of urea, and India's new round of tenders increased China's export expectations. Strong emotions led to an increase in urea prices in the short term, and profits were also driving up. On the whole, it is expected that urea prices will continue to rise mainly in the near future.