- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

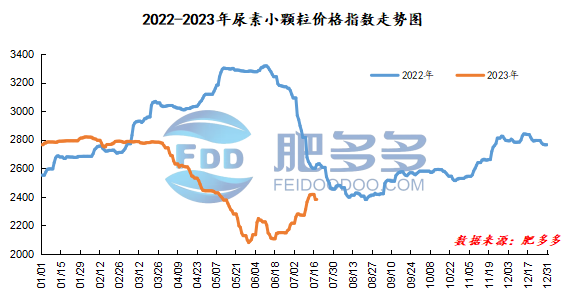

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 18 was 2,381.36, down 0.45 from yesterday, down 0.02% month-on-month, and down 9.33% year-on-year.

Urea futures market:

The Urea UR2309 contract price rose sharply again today after falling yesterday. The intraday low was 2000 at the opening of early trading, and then the futures price continued to fluctuate. In the afternoon, the futures price stabilized first and then rose. After climbing to a peak of 2123, it fluctuated within a narrow range, and closed at 2114 at the end. The opening price of the Urea UR2309 contract: 2000, the highest price: 2123, the lowest price: 2000, the settlement price: 2066, the closing price increased by 122 compared with the settlement price of the previous trading day, and the month-on-month increase of 6.12%. The daily fluctuation range is 2000-2123, and the spread is 123; the 09 contract has increased its position by 39073 lots today, and the position held so far is 365968 lots.

Spot market analysis:

Today, China's urea spot market quotes were sporadically lowered. The strong rebound in futures in the afternoon combined with the rise in urea prices in the international market caused an increase in the wait-and-see atmosphere in the spot market. Downstream demand temporarily slowed down, and the market transaction atmosphere was general. Specifically, prices in Northeast China have stabilized at 2,170 - 2,250 yuan/ton. Prices in North China fell to 2,180 - 2,310 yuan/ton. Prices in Northwest China fell to 2,350 - 2,460 yuan/ton. Prices in Southwest China fell to 2,350 - 2,900 yuan/ton. Prices in East China fell to 2,300 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,320 - 2,500 yuan/ton, and the price of large particles stabilized at 2,300 - 2,330 yuan/ton. Prices in South China fell to 2,550 - 2,620 yuan/ton.

Market outlook forecast:

From the perspective of futures, futures prices rebounded strongly today, and the trend of the two markets has been phased. The rebound of futures has intensified the wait-and-see mood in the spot market. Fundamentally speaking, supply manufacturers are waiting for support and inventories are tight, so there is sufficient supply, the industry starts to maintain a high level, and there is little pressure to remove warehouses in a short period of time. However, due to the gradual slowdown in downstream demand, the current urea market sentiment has become increasingly cautious, and resistance to high-priced transactions is gradually increasing. In terms of industrial demand, plywood factories continue to focus on purchasing, compound fertilizers are still at a relatively low level, and urea is maintained for purchasing a small amount of raw materials. In terms of raw materials, the prices of synthetic ammonia and sulfur are steadily adjusted. In terms of inventories, China's inventories are still low in the short term, and as demand decreases, it is speculated that a small amount of inventories will be accumulated after a certain period of time. To sum up, it is expected that the urea spot market will continue to decline sporadically in the short term.