- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

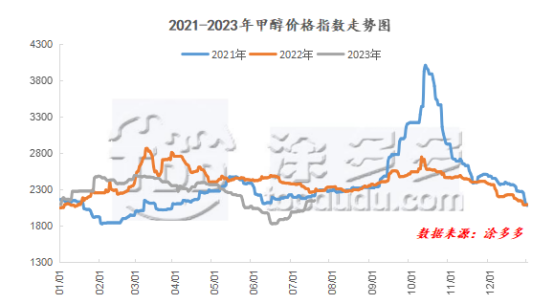

On July 18, the methanol market price index was 2150.04, up 10.16 from yesterday and 0.47 per cent from the previous month.

Outer disk dynamics:

Methanol closed on July 17:

China CFR 256-262USD / ton, down US $2.00 / tonne

European FOB 197.25-199.25 euros / ton, up 0.25 euros / ton

Us FOB 68-70 cents per gallon, down 0.75 cents per gallon

CFR in Southeast Asia is US $288-290 per ton, flat.

Summary of today's prices:

Guanzhong: 2050-2080 (0), South: 2050-2060 (100), North: 1980-2020 (- 30), Lunan: 2300 (0), Henan: 2150-2210 (- 10), Shanxi: 2120-2240 (0), Port: 22502280 (40)

Freight:

North Route-Northern Shandong 240-310 (- 20amp 0), Southern Route-Northern Shandong 250-330 (0mp 0), Shanxi-Northern Shandong 120-170 (- 10max 0), Guanzhong-Southwest Shandong 210-270 (- 20max 0)

Spot market: today, the price of methanol market rises in a narrow range, the price volatility of the Chinese market is 10-50 yuan / ton, the volatility of the futures market is strong, the port spot goes up with the market, the transaction is general, and the cost side is good. Coupled with the downstream replenishment demand, the price in the Chinese market has risen mainly, and the overall transaction situation is better. Specifically, the market prices in the main producing areas are mixed, and the price is quoted on the southern route today. 2050-2060 yuan / ton, the low end increases 100 yuan / ton, the north line quotes 1980-2020, the low end is reduced by 30 yuan / ton, affected by the rising futures market, downstream rigid demand replenishment, some manufacturers auction transactions are good, the market atmosphere has improved, in the later stage, we also need to pay attention to the operation of the equipment in the field. The price of the consumer market is weak, among which Lunan 2300 yuan / ton, low-end stability, northern Shandong 2280-2300 yuan / ton, low-end down 10 yuan / ton, the mentality of the field operators is strong, the current market operators are cautious, downstream enterprises wait and see mainly. Prices in central China are arranged in a narrow range, of which Henan is quoted at 2150-2210 yuan / ton, and the high end is raised by 10 yuan / ton. some enterprises in the market have a good deal at auction and replenish goods on demand downstream. The price in southwest China rose partially, with Sichuan and Chongqing around 2180-2300 yuan / ton, with a low-end increase of 80 yuan / ton, and Yunnan-Guizhou region 2140-2230 yuan / ton. Yesterday, part of the equipment in the field was parked, the supply pressure was not great, and the downstream maintained rigid demand. Market inquiry is active and the negotiation mood is good. Quotations in other regions of China have also been adjusted to varying degrees.

Port market: methanol futures fluctuated upwards today. Spot rigid demand buying and selling. Long-term unilateral high shipments, arbitrage buying mainly, the afternoon discussion atmosphere strengthened, the basis is slightly weaker. The overall deal is OK. Taicang main port transaction price: spot / 7: 2250-2280, basis 09-7 prime price: 2260-2290, basis difference 09 / 7 prime 10 transaction 8 transaction: 2260-2300, base difference 09 / 10 pound 15 transaction 9 transaction: 2290-2315, basis 09 / 25 pound / 30pm 10 / 10, basis 09 / 25 / 10 / 10 / 10 / 10 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 /

|

Area |

2023/7/18 |

2023/7/17 |

Rise and fall |

|

The whole country |

2150.04 |

2139.88 |

10.16 |

|

Northwest |

1980-2100 |

1950-2100 |

30/0 |

|

North China |

2090-2300 |

2120-2280 |

-30/20 |

|

East China |

2250-2360 |

2210-2360 |

40/0 |

|

South China |

2230-2340 |

2230-2340 |

0/0 |

|

Southwest |

2140-2300 |

2100-2250 |

40/50 |

|

Northeast China |

2200-2500 |

2200-2500 |

0/0 |

|

Shandong |

2280-2330 |

2290-2360 |

-10/-30 |

|

Central China |

2140-2480 |

2150-2480 |

-10/0 |

Future forecast: the recent steady rise in coal prices, the gradual release of terminal demand coupled with coal mine inspection, the coal market has warmed up, the cost side is favorable to support, the futures market volatility has risen, coupled with the low inventory of methanol plants in China, the market trading sentiment has improved. According to the fundamentals of methanol supply and demand, there are both overhaul and restart of the plant in the field at present. With the gradual recovery of the previous overhaul unit, in late July, the units such as Kunpeng in Ningxia, Huating in Gansu, Yigao in Inner Mongolia and carbon Xin in Anhui are planned to restart, and the supply and storage in the field is expected to increase. Follow-up attention is paid to the restart of the unit. From the demand side, the downstream olefin enterprises are continuously external mining, and the MTO demand is expected to increase. The demand of other downstream plants is relatively stable, and the overall demand does not change much. In the later stage, we need to pay attention to the load changes of olefin units in the field and the commissioning of new units. At present, the cost has been temporarily supported and the market sentiment has warmed up, but both supply and demand are expected to increase, and the short-term methanol market price is expected to be arranged in a narrow range. In the later stage, we also need to pay close attention to the macro view, coal prices and the operation of the plant in the field.

Recent operation of the device:

|

Name of production enterprise |

Annual capacity; ten thousand tons |

Raw material |

Starting date of maintenance |

Maintenance end date |

Operation of the device |

|

Shaanxi Lean |

26 |

Coal |

2023/7/1 |

2023/7/16 |

Rebooting |

|

Yizhou science and technology |

15 |

Coke oven gas |

2023/7/10 |

2023/7/17 |

Rebooting |

|

Inner Mongolia Yigao |

30 |

Coal |

2023/6/23 |

2023/7/19 |

Planned maintenance for 1 month |

|

Yangmei Fengxi |

10 |

Coal |

2023/7/1 |

2023/7/21 |

Stop the car. |

|

Henan Zhongxin |

35 |

Coal |

2023/7/7 |

2023/7/22 |

Parking maintenance |

|

Anhui carbon Xin |

50 |

Coke oven gas |

2023/5/4 |

2023 / lower middle and lower July |

Plan to restart |

|

Jiutai |

200 |

Coal |

2023/7/13 |

2023 / lower middle and lower July |

It is expected that the maintenance time will last about 10 days. |

|

Kunpeng, Ningxia |

60 |

Coal |

2023/6/12 |

2023 / lower middle and lower July |

Parking |

|

The first phase of New Olympic Games in Inner Mongolia |

60 |

Coal |

2023/7/4 |

2023/7/24 |

Parking maintenance |

|

Huangling, Shaanxi Province |

30 |

Coke oven gas |

2023/6/25 |

2023 / lower middle and lower July |

Planned maintenance for 20 days |

|

Yanzhou Mining Guohong |

64 |

Coal |

2023/7/13 |

2023 / July |

Plan to park for 5-7 days |

|

Shaanxi evergreen |

60 |

Coal |

2023/7/11 |

2023/7/30 |

Parking maintenance |

|

Henan heart to heart |

60 |

Coal |

2023/6/28 |

2022 / end of July |

Parking maintenance |

|

Cathay Pacific |

40 |

Coal |

2023/6/22 |

2023 / end of July |

Parking maintenance |

|

Gansu Huating |

60 |

Coal |

2023/7/12 |

To be determined |

Temporary car bounce |

|

Shaanxi Shenmu |

60 |

Coal |

2023 / end of July |

2023 / August |

Planned maintenance for 15 days |

|

Inner Mongolia Shilin |

30 |

Coal |

2023 / late July |

2023 / September |

Planned maintenance for 2 months |

|

The second phase of Xinao, Inner Mongolia |

60 |

Coal |

2023 / August |

2023 / mid-August |

Planned maintenance for 20 days |

|

Inner Mongolia ancient and Baitai |

10 |

Coke oven gas |

2023/5/21 |

To be determined |

Parking maintenance |

|

Sichuan Lutianhua |

40 |

Natural gas |

2023/6/30 |

To be determined |

Parking maintenance |

|

Chongqing Cabelle |

85 |

Natural gas |

2023/7/4 |

To be determined |

Parking maintenance |

|

Shanxi coking |

40 |

Coke oven gas |

2023/5/15 |

To be determined |

Reduce negative production |

|

Central Plains Dahua |

50 |

Coal |

2023/7/7 |

To be determined |

Restart failed and is still in parking state |