- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

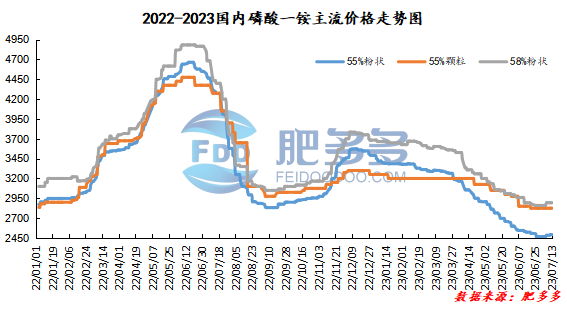

Monoammonium phosphate price index:

According to Feiduo data, on July 13, the 55% powder index of China's monoammonium phosphate was 2491.25, stable; the 55% particle index was 2825.00, stable; and the 58% powder index was 2893.33, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market is operating smoothly, with few new orders, and the market maintains a wait-and-see atmosphere. On the demand side, as the progress of fertilizer preparation in autumn slowly begins, the start of downstream compound fertilizer factories has increased within a narrow range, and the purchase of monoammonium has increased slightly. It is reported that Sichuan needs to carry out safety inspections in the near future, and the output of some mines will be affected. Coupled with the increase in phosphate rock consumption in autumn, there may be a shortage of phosphate rock market supply, and prices will rise again. The prices of raw materials synthetic ammonia and sulfur are mixed, and cost support no longer moves downward. Overall, the monoammonium market is stabilizing and waiting, and continues to pay attention to the increase in downstream start-ups.

Specific market prices in each region are as follows:

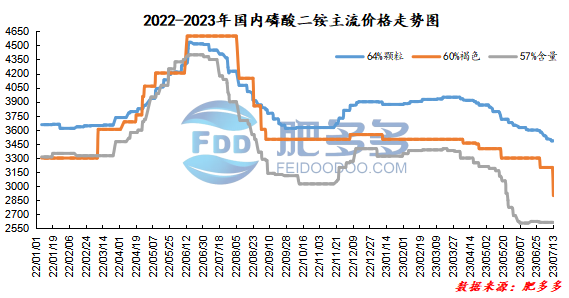

Diammonium phosphate price index:

According to Feiduo data, on July 13, the 64% particle index of China's mainstream diammonium phosphate was 3,483.33, which was stable; the 60% brown index was 2,900.00, which fell; and the 57% content index was 2615, which was stable.

Diammonium phosphate market analysis and forecast:

Today, there has been no significant fluctuations in the mainstream market of diammonium phosphate in China. Only the price of 60% brown in Shanxi has dropped sharply by 300 yuan/ton to 2900 yuan/ton. It is reported that demand in Shaanxi is weak and prices have been lowered across the board. Upstream prices are mixed, and cost support no longer moves downward, but it is also difficult to inject positive sentiment into the phosphate fertilizer market. The supply side has increased within a narrow range compared with the previous period. Driven by the previous wave of downstream stocking, factory inventory pressure is not great. At present, diammonium companies do not have many orders in China and mainly rely on export orders. However, export prices are still low and corporate profits are limited. Looking at the weak and stable operation of the diammonium market in the short term, it is unlikely that quotations from various places will move downwards significantly, but there will still be sporadic downward adjustments.

Specific market prices in each region are as follows: