- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

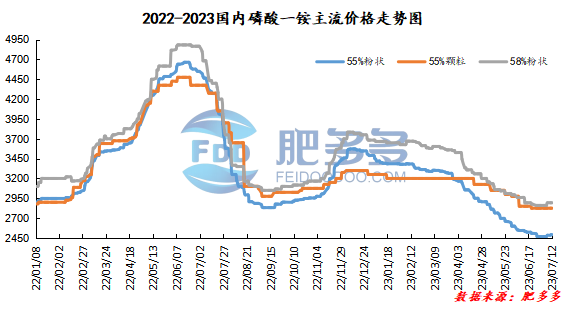

Monoammonium phosphate price index:

According to Feiduo data, on July 12, the 55% powder index of China's monoammonium phosphate was 2491.25, stable; the 55% particle index was 2825.00, stable; and the 58% powder index was 2893.33, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market is in a stalemate, and market trading has not seen a significant improvement. The rising atmosphere in the early stage has gradually subsided as trading sentiment declines. The raw material synthetic ammonia market remained mixed, with the overall decline in the northern market and the southern market stable and continuing to rise; the phosphate rock market was bearish, but it maintained stability for a short time. Although cost support was difficult to show significant benefits, it had stopped falling and rebounded. On the supply side, factories rely on early orders. Due to rising temperatures or short-term parking with equipment, the overall industry starts have increased slightly from last week, and inventory pressure is also weakening. On the demand side, as the progress of fertilizer preparation in autumn slowly expands, the construction of downstream compound fertilizer factories has shown slight improvement. In the short term, the monoammonium market will stabilize and wait and see, paying attention to downstream start-ups and cost rebound.

Specific market prices in each region are as follows:

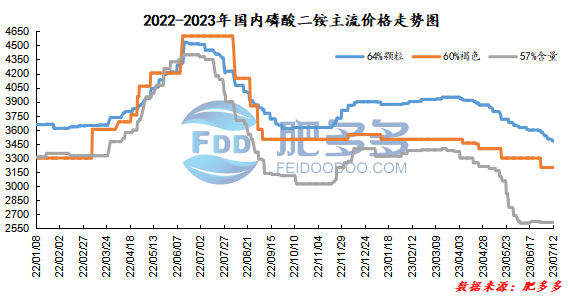

Diammonium phosphate price index:

According to Feiduo data, on July 12, the 64% particle index of China's mainstream diammonium phosphate was 3,483.33, temperature; the 60% brown index was 3,200.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

There has been no significant change in the market price of diammonium phosphate in China today. The Heilongjiang region has stopped quoting, and the market is still shrouded in bearish sentiment. The rise in raw material market prices has brought some good news to the diammonium market, but the diammonium market has not improved significantly in terms of demand, and the trading atmosphere in the monoammonium market is even more depressed. The supply side has increased within a narrow range compared with the previous period. Driven by the previous wave of downstream stocking, factory inventory pressure is not great. At present, diammonium companies do not have many orders in China and mainly rely on export orders. However, export prices are still low and corporate profits are limited. In the short term, the diammonium market will operate weakly and steadily.

Specific market prices in each region are as follows: