- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

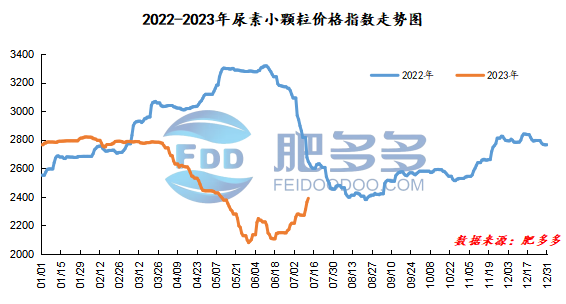

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 12 was 2,390.00, up 26.36 from yesterday, up 1.12% month-on-month, and down 9.69% year-on-year.

Urea futures market:

The price of the urea UR2309 contract resumed its rise again today. It opened at the lowest point in early trading, and then the futures price continued to rise, reaching today's highest point of 2076 before noon. In the afternoon, the futures price fluctuated at a high level and closed at 2070 at the end. The opening price of the Urea UR2309 contract: 2000, the highest price: 2076, the lowest price: 2000, the settlement price: 2049, the closing price: 2070, the closing price increased by 79 compared with the settlement price of the previous trading day, and the month-on-month increase by 3.97%. The daily fluctuation range is 2000-2076, and the spread is 76; The 09 contract has increased its positions by 20478 lots today, and so far, it has held 387592 lots.

Spot market analysis:

Today, the price of urea in China's spot market has partially increased, with price fluctuations ranging from 20 to 110 yuan/ton. International urea prices continue to rebound, export orders continue to increase, coupled with a strong upward trend in futures prices, market sentiment remains high, and traders are still willing to raise prices downstream to buy goods. Specifically, prices in Northeast China have stabilized at 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,190 - 2,380 yuan/ton. Prices in the northwest region are stable at 2,350 - 2,360 yuan/ton. Prices in Southwest China are stable at 2,300 - 3,000 yuan/ton. Prices in East China rose to 2,330 - 2,400 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,300 - 2,500 yuan/ton, and the price of large particles rose to 2,250 - 2,310 yuan/ton. Prices in South China rose to 2,550 - 2,650 yuan/ton.

Market outlook forecast:

From the perspective of futures, futures prices are rising strongly, and the two markets are currently growing in the same direction. Only the basis in the Northeast region has narrowed, and futures are emotionally positive for the rise in spot prices. Fundamentally speaking, with the development of fertilization in autumn, downstream compound fertilizer factories will have a certain increase in demand for urea, but with high phosphorus fertilizer in autumn, the demand for urea will not be too high. As the international price of urea is also rising, export orders have increased and foreign demand has improved. On the supply side, short-term temperature increases in China have led to an increase in the frequency of equipment failures, a short-term decline in industry start-ups, and a tight supply of goods in the region. On the cost side, the price of anthracite lump coal has bottomed out, and the cost of fixed beds has ended its decline. In terms of inventories, China's inventories are low, and it is speculated that stocks will gradually accumulate in the later period as demand decreases. To sum up, the short-term supply-demand game in the spot market is fierce, and it is necessary to pay close attention to product exports and the implementation of new production capacity in order to infer changes in demand as soon as possible.