- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

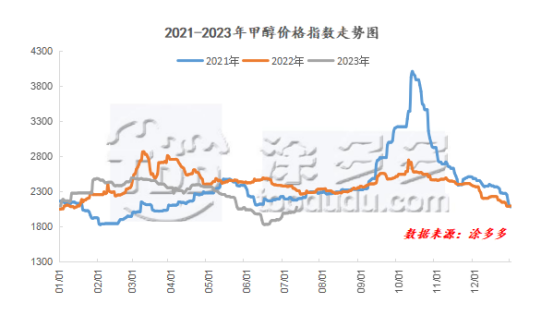

On July 12, the methanol market price index was 2132.68, up 54.95 from yesterday and 2.64 per cent from the previous month.

Outer disk dynamics:

Methanol closed on July 11:

China CFR 257-259 US dollars / ton, up 9 US dollars / ton

European FOB 194196 euros / ton, up 0.75 euros / ton

Us FOB 70-72 cents per gallon, flat

CFR in Southeast Asia is US $288-290 per ton, flat.

Summary of today's prices:

Guanzhong: 2050-2080 (70), South: 1950-1970 (90), North: 1950-1990 (10), Lunan: 2280-2300 (40), Henan: 2210-2230 (60), Shanxi: 21202200 (120), Port: 22502260 (40)

Freight:

North Route-Northern Shandong 210-310 (- 10 Uniqure 10), Southern Route-Northern Shandong 250-330 (- 10 Maple 0), Shanxi-Northern Shandong 120-170 (- 10 Maple 0), Guanzhong-Southwest Shandong 200-240 (20max 10)

Spot market: today, the current center of gravity of methanol futures continues to rise, supported by favorable news, the futures market has hit a new high in stages, hitting the highest price since May 18, the price in the Chinese market has been continuously raised, and the trading atmosphere in the market has improved compared with the previous period. However, due to the recent rapid increase in methanol prices, some operators in the market are becoming more cautious. Specifically, the price quoted by the manufacturers in the main producing areas remains high under the support of little inventory pressure. today, the quotation on the south line is 1950-1970 yuan per ton, the low end is raised by 90 yuan per ton, and the price on the north line is quoted. From 1950 to 1990, the low end was raised by 10 yuan per ton, and manufacturers shipped smoothly, with little inventory pressure. Changqing quotation continued to be raised, and Changqing quoted price was raised three times during the week. at present, the plant is parking 600000 tons of equipment, which is expected to be about 15-20 days. We still need to pay close attention in the later stage. The market price of the place of consumption has been raised along with it, including 2280-2300 yuan / ton in southern Shandong, 40 yuan / ton in the low end, and 40 yuan / ton in northern Shandong. 2250-2280 yuan / ton, the low-end increase of 10 yuan / ton, the mentality of the market is strong, but the overall cautious mood still exists, the market transaction atmosphere is general. The quotation in the southwest region is around 2100-2200 yuan per ton. with the rise of the temperature, some of the devices in the field are affected by high temperature, the market supply pressure is not great, the rigid demand for terminal transactions is mainly, and the market negotiation mood is general. Quotations in other regions of China have also been adjusted to varying degrees.

Port market: today, methanol futures volatility is strong. Spot demand is mediocre. Paper arbitrage and exchange are in the majority, the unilateral offer is cautious, and the basis is stable. The overall deal is OK. Taicang main port transaction price: small order transaction: 2240-2250, basis 09-10 position 7 in transaction: 2250-2270, basis 09-0 prime position 5 position 7 transaction: 2270-2290, base difference 09 / 10 / 10 / 15 / 8 transaction: 2280 / 2300, basis 09 / 20 / 20 / 22 / 9 / deal: 2290 / 2305, basis / 09 / 30 / 10 / 10 / 10 / 10 / 10 / 10 / 10 / 22 / 9 / 09 / 20 / 22 / 9 / 10 / 10 / 22 / 9 / 10 / 10 / 22 / 9 / 10 / 10 / 22 / 9 / 9 / 10 / 10 / 22 / 9 / 9 / 10 / 10 / 22 / 9 / 10 / 10 / 10 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 7 / 10 / 10 / 7 / 7 / 7 / 7 /

|

Area |

2023/7/12 |

2023/7/11 |

Rise and fall |

|

The whole country |

2132.68 |

2077.73 |

54.95 |

|

Northwest |

1950-2080 |

1860-2030 |

90/50 |

|

North China |

2120-2250 |

2000-2200 |

120/50 |

|

East China |

2250-2360 |

2210-2350 |

40/10 |

|

South China |

2230-2280 |

2170-2230 |

60/50 |

|

Southwest |

2100-2200 |

2100-2200 |

0/0 |

|

Northeast China |

2200-2500 |

2200-2450 |

0/50 |

|

Shandong |

2250-2370 |

2200-2330 |

50/40 |

|

Central China |

2210-2480 |

2150-2500 |

60/-20 |

Forecast in the future: the center of gravity of the methanol market continues to rise recently under the support of multiple advantages, some downstream enterprises in China frequently mine outside, and the supply recovery is not as expected, the mentality of the operators in the market is improved, traders actively enter the market to replenish goods, and the market trading atmosphere is improved. manufacturers are obviously willing to increase prices under the support of little inventory pressure, and with the increase of temperature, the demand for coal for power plants has increased, and coal prices in production areas have stopped falling and stabilized. The cost side is also supported by methanol. In the port market, with the continuous increase in prices, most shippers are willing to ship when they are high, the downstream replenishment enthusiasm is general, and the transaction atmosphere in the spot market is limited. Up to now, the total inventory in the port area has decreased, and the foreign acquisition of downstream MTO and the arrival speed of imported shipments are general, resulting in some port inventory going to the warehouse slightly. At present, the sharp increase in the futures market has led to an improvement in market sentiment, coupled with the fact that the inventory pressure of most Chinese manufacturers is not great, and the manufacturers' price-raising sentiment is obvious, and it is expected that the methanol market price will fluctuate at a high level in the short term. in the later stage, we also need to pay close attention to the macro view, coal prices and the operation of the plant in the field.

Recent operation of the device:

|

Name of production enterprise |

Annual capacity; ten thousand tons |

Raw material |

Starting date of maintenance |

Maintenance end date |

Operation of the device |

|

Kunpeng, Ningxia |

60 |

Coal |

2023/6/13 |

2023 / mid-July |

Plan to restart |

|

Shaanxi Lean |

26 |

Coal |

2023/7/1 |

2023/7/16 |

Parking maintenance |

|

China-Angola alliance |

170 |

Coal |

2023/6/30 |

2023 / mid-July |

Plan to restart in the near future |

|

Anhui carbon Xin |

50 |

Coke oven gas |

2023/5/4 |

2023 / mid-July |

Plan to restart |

|

Huangling, Shaanxi Province |

30 |

Coke oven gas |

2023/6/25 |

2023 / lower middle and lower July |

Planned maintenance for 20 days |

|

Yangmei Fengxi |

10 |

Coal |

2023/7/1 |

2023/7/21 |

Stop the car. |

|

Inner Mongolia Yigao |

30 |

Coal |

2023/6/23 |

2023 / July |

Planned maintenance for 1 month |

|

The first phase of New Olympic Games in Inner Mongolia |

60 |

Coal |

2023/7/4 |

2023/7/24 |

Parking maintenance |

|

Shaanxi evergreen |

60 |

Coal |

2023/7/11 |

2023/7/30 |

Parking maintenance |

|

Henan heart to heart |

60 |

Coal |

2023/6/28 |

2020 / end of July |

Parking maintenance |

|

Cathay Pacific |

40 |

Coal |

2023/6/22 |

2023 / end of July |

Parking maintenance |

|

Shaanxi Shenmu |

60 |

Coal |

2023 / end of July |

2023 / August |

Planned maintenance for 15 days |

|

Inner Mongolia Shilin |

30 |

Coal |

2023 / late July |

2023 / September |

Planned maintenance for 2 months |

|

The second phase of Xinao, Inner Mongolia |

60 |

Coal |

2023 / August |

2023 / mid-August |

Planned maintenance for 20 days |

|

Inner Mongolia ancient and Baitai |

10 |

Coke oven gas |

2023/5/21 |

To be determined |

Parking maintenance |

|

Sichuan Lutianhua |

40 |

Natural gas |

2023/6/30 |

To be determined |

Parking maintenance |

|

Chongqing Cabelle |

85 |

Natural gas |

2023/7/4 |

To be determined |

Parking maintenance |

|

Shanxi coking |

40 |

Coke oven gas |

2023/5/15 |

To be determined |

Reduce negative production |