- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

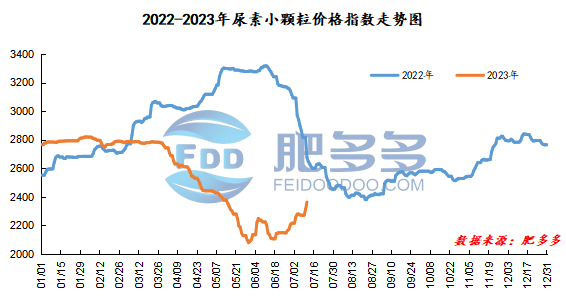

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 11 was 2,363.64, up 51.82 from yesterday, up 2.24% month-on-month, and down 11.69% year-on-year.

Urea futures market:

The Urea UR2309 contract opened higher again today and then weakened within a narrow range. The price immediately peaked at 2022 in the early opening period. After that, it fell in a narrow range and surged again, but the strength was insufficient. The shock ran until the end, and the price closed at 1987 at the end. Opening price of the Urea UR2309 contract: 2015, highest price: 2022, lowest price: 1975, settlement price: 1991, closing price: 1987. The closing price increased by 20 compared with the settlement price of the previous trading day, and increased by 1.02% month-on-month. The daily fluctuation range is 1975-2022, and the spread is 47; The 09 contract has reduced its position by 40150 lots today, and so far, it has held 367114 lots.

Spot market analysis:

Today, China's urea spot market has once again pulled up across the board, with price increases ranging from 20 to 275 yuan/ton, and new orders are still increasing. At this stage, downstream agricultural fertilizer preparation is progressing slowly, and good export expectations have boosted spot market sentiment and even promoted procurement in terms of industrial demand. The company's spot shipping area is tight, so the quotation continues to increase. Specifically, prices in Northeast China have stabilized at 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,180 - 2,250 yuan/ton. Prices in Northwest China rose to 2,350 - 2,360 yuan/ton. Prices in Southwest China rose to 2,300 - 3,000 yuan/ton. Prices in East China rose to 2,280 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,290 - 2,480 yuan/ton, and the price of large particles rose to 2,250 - 2,270 yuan/ton. Prices in South China rose to 2,550 - 2,600 yuan/ton.

Market outlook forecast:

From the perspective of futures, futures prices opened higher again, and the disk repair drive strengthened. However, there was insufficient support in the later period or upward movement, which would provide a positive injection into the spot in the short term. Fundamentally speaking, the urea supply side will still face 3.8 million tons of production capacity put on the market in the second half of the year. In the near future, it is still a seasonal off-season for agricultural demand, and China's urea supply and demand are facing tremendous pressure. However, from a sub-regional perspective, supply and demand in most regions are tightening, with rising prices being the biggest manifestation. Recently, urea plants have been suspended or overhauled in the international market, and international prices have continued to rise due to tight supply. This has significantly supported the Chinese urea market and supported exports. However, if demand in the later period falls short of expectations, weakening domestic demand and high supply will once again lead to significant price cuts in spot prices and containment of futures. To sum up, the game between supply and demand in the spot market is fierce, and it is necessary to pay close attention to India's bidding information and export situation in order to infer changes in demand as soon as possible.