- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

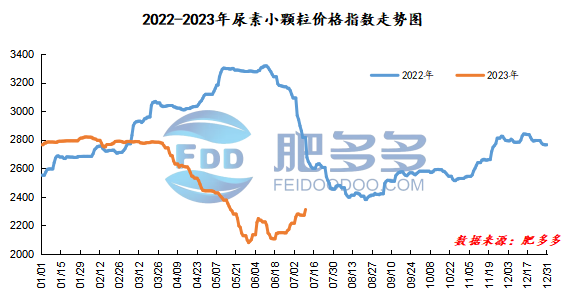

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 10 was 2,311.82, up 40.45 from yesterday, up 1.78% month-on-month, and down 17.90% year-on-year.

Urea futures market:

The futures price of the urea UR2309 contract opened higher today and closed strongly. After the opening of early trading, futures prices fluctuated and rose close to the daily limit. In the afternoon, futures prices fluctuated at a high level, closing at daily limit, and closing at 1999 at the end of the day. The opening price of the Urea UR2309 contract: 1935, the highest price: 1999, the lowest price: 1925, the settlement price: 1967, the closing price increased by 131 compared with the settlement price of the previous trading day, and the month-on-month increase of 7.01%. The daily fluctuation range is 1925-1999, and the spread is 74; The 09 contract increased its position by 3225 lots today, and the position held so far is 407264 lots.

Spot market analysis:

Most of China's urea spot prices rose again today, with quotes in mainstream regions rising by 50-170 yuan/ton. At present, most of the demand for urea is boosted by downstream compound fertilizer plants to replenish warehouses and export expectations. Last week, the urea market rose first and then declined. Currently, market inventories continue to be low, and downstream caution is gradually increasing. Specifically, prices in Northeast China have stabilized at 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,140 - 2,250 yuan/ton. Prices in the northwest region are stable at 2,240 - 2,250 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,700 yuan/ton. Prices in East China rose to 2,240 - 2,330 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,240 - 2,380 yuan/ton, and the price of large particles rose to 2,210 - 2,220 yuan/ton. Prices in South China rose to 2,430 - 2,550 yuan/ton.

Market outlook forecast:

From the perspective of futures, the early weekly futures price opened higher and daily limit, mainly due to improving export expectations, the news of Indian bidding came out, and the driving force for market repair intensified. Fundamentally speaking, the urea supply side will face 3.8 million tons of production capacity put on the market in the second half of the year. However, the recent period is still a seasonal off-season for agricultural demand, and China's urea supply and demand are facing tremendous pressure. Recently, urea plants have been suspended or overhauled in the international market, and international prices have continued to rise due to tight supply. This has significantly supported the Chinese urea market and supported exports. However, if demand in the later period falls short of expectations, weakening domestic demand and high supply will once again lead to significant price cuts in spot prices and containment of futures. To sum up, the market situation is fierce between supply and demand, and it is necessary to pay close attention to India's bidding information and export situation in order to infer changes in demand as soon as possible.