- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

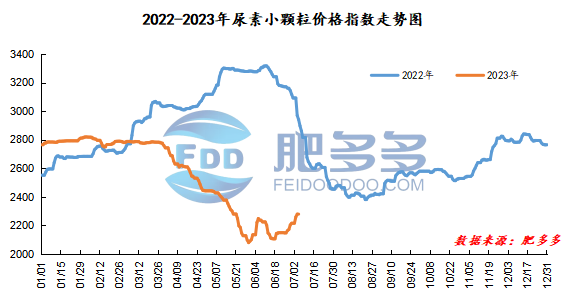

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 5 was 2,280.91, up 1.59 from yesterday, up 0.07% month-on-month, and down 22.46% year-on-year.

Urea futures market:

The overall futures price of the urea UR2309 contract continued to move downward today. After the opening, the intraday high of 1863 first appeared, and then the futures price continued to fluctuate and decline. Afternoon futures fell to an intraday low of 1810 and closed at 1813 in late trading. The opening price of the Urea UR2309 contract: 1861, the highest price: 1863, the lowest price: 1810, the settlement price: 1827, and the closing price: 1813. The closing price dropped 51 compared with the settlement price of the previous trading day, and the month-on-month decline was 2.74%. The daily fluctuation range was 1810-1863, and the spread was 53; the 09 contract increased its position by 12520 lots today, and the position held so far was 418917 lots.

Spot market analysis:

Today, China's urea spot prices continued to be mixed, and the progress of on-site transactions slowed down. Among them, mainstream quotes in Dali, Yunnan continued to rise by 100 yuan/ton to 2675 yuan/ton. There are not many parking and maintenance projects for upstream units in the spot market, and the overall start remains high, and the supply is still sufficient. In terms of demand, although industrial demand performed generally, there were more factories to go, and with appropriate support from agricultural demand, the mainstream quotations in the market were firm. Specifically, the price in Northeast China is 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,100 - 2,250 yuan/ton. Prices in Northwest China rose to 2,280 - 2,290 yuan/ton. Prices in Southwest China rose to 2,200 - 2,650 yuan/ton. Prices in East China rose to 2,180 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,380 yuan/ton, and the price of large particles stabilized at 2,150 - 2,220 yuan/ton. Prices in South China have stabilized at 2,400 - 2,510 yuan/ton.

Market outlook forecast:

From the perspective of futures, the market futures price has gradually declined in recent days, and the trend is difficult to support the spot market. Fundamentally speaking, urea supply is expected to have 3.8 million tons of production capacity put on the market in the first and second half of the year. The mentality of the industry is bearish. In the long run, the pressure on urea supply cannot be underestimated, and the supply will remain sufficient and stable in the short term. On the demand side, although downstream agricultural demand has slowed down, it still has certain positive support. In terms of industrial demand, as mentioned above, it mainly relies on factories to support it in the short term. Overall, demand is temporarily positive. To sum up, in the short term, it is inferred that the market situation is dominated by the game between supply and demand, and the market is dominated by stable and positive operations. In the long run, as demand weakens, if the situation of oversupply cannot be reversed, it is inevitable that the market will decline.