- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

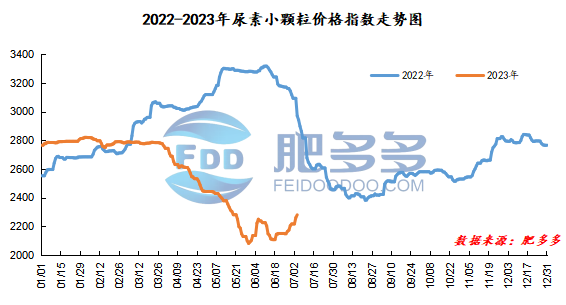

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 4 was 2,279.32, up 19.55 from yesterday, up 0.86% month-on-month, and down 23.26% year-on-year.

Urea futures market:

The overall futures price of the Urea UR2309 contract moved down within a narrow range today, but the market surface changed little, and the open position fluctuated little. After the opening, the intraday high of 1885 first appeared, and then the futures price began to decline. It reached the intraday low of 1848 and then pulled back. However, the futures price lacked momentum to rise, and it fluctuated until the end, and closed at 1870 at the end. The opening price of the Urea UR2309 contract: 1868, the highest price: 1885, the lowest price: 1848, the settlement price: 1864, the closing price has not fluctuated compared with the settlement price of the previous trading day. The fluctuation range throughout the day is 1848-1885, and the spread is 37; The 09 contract has increased its position by 316 lots today, and so far, it has held 406397 lots.

Spot market analysis:

Today, China's urea spot prices are mixed. It is worth noting that mainstream prices in Dali, Yunnan have surged by 300 yuan/ton to 2575 yuan/ton, mainly due to better on-site demand and low inventories. Over time, downstream demand has gradually slowed down, so the pace of market growth has slowed down. Some regions have already resisted high prices, so market prices are mixed and the market has loosened. Specifically, the price in Northeast China is 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,100 - 2,250 yuan/ton. Prices in Northwest China rose to 2,280 - 2,290 yuan/ton. Prices in Southwest China rose to 2,200 - 2,650 yuan/ton. Prices in East China rose to 2,180 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,380 yuan/ton, and the price of large particles stabilized at 2,150 - 2,220 yuan/ton. Prices in South China have stabilized at 2,400 - 2,510 yuan/ton.

Market outlook forecast:

From the perspective of futures, today's market trend has not changed much, and the number of positions has increased little, which cannot provide ideas for the spot trend for the time being. Fundamentally speaking, urea supply has implemented the release of 1.3 million tons of new production capacity in the first half of the year, and 3.8 million tons of production capacity is still expected to be put on the market in the second half of the year. In the long run, the overall supply pressure of urea is not optimistic, but in the short term, the supply has not changed much. On the demand side, downstream agricultural demand may have concentrated procurement in the short term. Orders from some urea companies are scheduled until mid-July, and export demand is considerable. The sentiment has also driven the domestic market. However, in the long run, since fertilization in autumn is not as strong as fertilization in spring and summer, demand in the second half of the year will be significantly lower than in the first half of the year, and it is difficult for farmers to use fertilizer on the scale of spring plowing again. On the whole, in the short term, the market is in a game of supply and demand, the market is operating steadily and consolidating, and the market's growth rate is slowing down. In the long run, the situation of oversupply in the market is difficult to reverse, which will further aggravate the downward volatility of the market.