- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

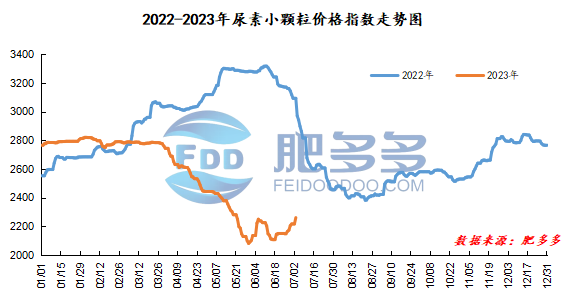

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on July 3 was 2,259.77, up 44.09 from last Friday, up 1.99% month-on-month, and down 26.93% year-on-year.

Urea futures market:

Today's futures price of the urea UR2309 contract showed a volatile downward trend. The intraday high of 1901 immediately appeared at the opening. After that, the futures price began to fall, falling to the lowest point of 1852 in the morning. After that, the futures price rebounded within a narrow range and continued to fluctuate, closing at 1867 at the end. The opening price of the Urea UR2309 contract: 1895, the highest price: 1901, the lowest price: 1852, the settlement price: 1870, the closing price: 1867, the closing price dropped 22, or 1.16% compared with the settlement price of the previous trading day. The daily fluctuation range is 1852-1901, and the price difference is 49; The 09 contract has reduced its position by 5866 lots today, and has held 406081 lots so far.

Spot market analysis:

At the beginning of the week, China's urea spot price continued to rise, with mainstream quotations in South and Central China rising by 50-130 yuan/ton. Although the transaction of new orders in China's spot market has slowed down, manufacturers 'shipments are still relatively tight, so the price has continued to rise. The price of raw material synthetic ammonia has stabilized and increased, and the downstream compound fertilizer market has stabilized and moved slightly. Specifically, prices in Northeast China have stabilized at 2,120 - 2,200 yuan/ton. Prices in North China rose to 2,130 - 2,230 yuan/ton. Prices in the northwest region are stable at 2,240 - 2,250 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,350 yuan/ton. Prices in East China rose to 2,190 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,150 - 2,380 yuan/ton, and the price of large particles rose to 2,150 - 2,220 yuan/ton. Prices in South China rose to 2,400 - 2,510 yuan/ton.

Market outlook forecast:

From the perspective of futures, the Bollinger Band's three-track futures price continued to break through at a high level last week, and the pressure level was blocked. The futures market had a lot of profit-taking sentiment near the high last week. Today's futures price fell within a narrow range, but the spot market price continued to rise firmly. Fundamentally speaking, supply has implemented the release of 1.3 million tons of new production capacity in the first half of the year, and it is expected that 3.8 million tons of production capacity will still be put on the market in the second half of the year. In the long run, the overall supply pressure of urea is not optimistic. On the demand side, downstream agricultural demand may have concentrated procurement in the short term. Orders from some urea companies are scheduled until mid-July, and export demand is considerable. The sentiment has also driven the domestic market. However, in the long run, demand in the second half of the year will be significantly lower than that in the first half of the year, and it is difficult for farmers to use fertilizer on the scale of spring plowing again. On the whole, in the short term, the market is in a game of supply and demand, and the market is moving steadily and upwards. In the long run, the oversupply of the market will further aggravate the downward volatility of the market.