- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

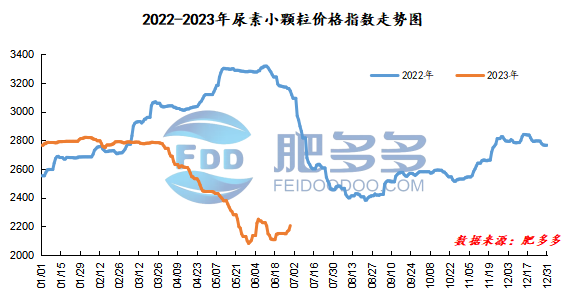

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 29 was 2,203.86, up 31.82 from yesterday, up 1.46% month-on-month, and down 29.92% year-on-year.

Urea futures market:

Today's futures price of the urea UR2309 contract showed a volatile upward trend. The lowest point of 1836 appeared at the opening, and it fluctuated upwards to the highest point of 1892 in the late session, which closed at 1890 in the late session. The opening price of the urea UR2309 contract: 1840, the highest price: 1892, the lowest price: 1836, the settlement price: 1870, and the closing price: 1890. Compared with the settlement price of the previous trading day, the closing price increased by 97, or 5.41%. The daily fluctuation range was 1836-1892, and the price difference was 56; The 09 contract increased its position by 16585 lots today, with 436391 lots held so far.

Spot market analysis:

Today, China's urea spot prices continue to rise, with mainstream prices in Sichuan increasing by 200 yuan/ton to 2200 yuan/ton, and in other regions increasing by 10-70 yuan/ton. The factory is currently in tight supply, advance orders are being delivered one after another, and inventory has dropped significantly. Export orders are also quietly increasing, and international prices are trying to bottom out. Specifically, prices in Northeast China rose to 2,120 - 2,300 yuan/ton. Prices in North China rose to 2,060 - 2,160 yuan/ton. Prices in Northwest China rose to 2,160 - 2,170 yuan/ton. Prices in Southwest China rose to 2,200 - 2,250 yuan/ton. Prices in East China rose to 2,150 - 2,230 yuan/ton. The price of small and medium-sized particles in Central China has stabilized to 2,100 - 2,310 yuan/ton, and the price of large particles has risen to 2,120 - 2,150 yuan/ton. Prices in South China rose to 2,300 - 2,380 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices rose sharply during the week, with the closing price rising by 185 yuan/ton. Spot prices also rose, and the basis weakened within a narrow range. At present, the two markets support each other, but it is observed that the Bollinger Band's three-track futures price continues to break through at a high level, and there may be a risk of decline later. From a fundamental point of view, supplies may be put into maintenance again in the next month and the beginning of the month, and short-term Nissan may fall slightly. In the long run, supply pressure will increase after the implementation of new production capacity. On the demand side, there is still centralized procurement downstream. Orders from some urea companies have been placed until mid-July, and export demand is still considerable. The sentiment has also driven the domestic market. On the whole, today's market demand has a good driving force for the market and may continue in the short term, so the market is moving steadily and upwards in the short term.