- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

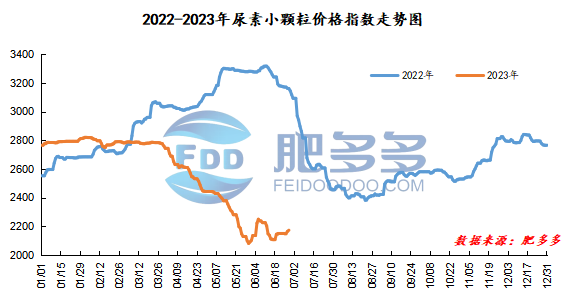

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 28 was 2,172.05, up 8.18 from yesterday, up 0.38% month-on-month, and down 31.24% year-on-year.

Urea futures market:

The Urea UR2309 contract opened at a low of 1764 in early trading today. After that, the futures price rose rapidly, rising to around 1800, and then fell back within a narrow range and began to operate in shock. In the afternoon, the futures price rose again to close, reaching a high of 1826 and closing at 1825 at the end. The opening price of the Urea UR2309 contract: 1764, the highest price: 1826, the lowest price: 1764, the settlement price: 1793, the closing price: 1825. The closing price increased by 63, or 3.58% compared with the settlement price of the previous trading day. The daily fluctuation range is 1764-1826, and the spread is 62; The 09 contract has reduced its position by 4014 lots today, and so far, it has held 419806 lots.

Spot market analysis:

The overall performance of China's urea spot market today was stable, and some factories had better orders. Therefore, the price increase was continued to be slightly increased, with the price increase ranging from 10 to 50 yuan/ton. During the week, regional seasonal agricultural demand support was acceptable, supply was sufficient, market supply and demand were in a game, prices increased slightly, and on-site trading sentiment was acceptable. Specifically, prices in Northeast China have stabilized at 2,110 - 2,300 yuan/ton. Prices in North China rose to 2,000 - 2,160 yuan/ton. Prices in Northwest China rose to 2,130 - 2,140 yuan/ton. Prices in Southwest China have stabilized to 2,000 - 2,250 yuan/ton. Prices in East China rose to 2,110 - 2,200 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,100 - 2,310 yuan/ton, and the price of large particles rose to 2,120 - 2,140 yuan/ton. Prices in South China have stabilized at 2,270 - 2,350 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures price reached a new high in the month, and the rally in the afternoon fermented, supporting the spot market. At the same time, spot farmers need to follow up, and the regionalization of the market appears. Fundamentally speaking, first of all, suppliers, affected by high temperature weather, have increased failures in urea production units, and start-up has fluctuated slightly. The daily output is close to 170,000 tons. However, considering the implementation of new production capacity in the later period, the pressure on urea supply still needs to be paid attention to. In the short term, the inventory of large factories in the field will be low, and the inventory will be accumulated later or as demand decreases. On the demand side, agricultural corn topdressing is underway in some northern regions, and the demand for rice fertilizer in the south is gradually starting, so the regional demand for agricultural needs is improving. However, in terms of industrial demand, plywood factories often use them as they please, and traders are cautious in purchasing and have a mentality of buying up rather than buying down. In terms of exports, export data in May improved significantly, driving the Chinese market emotionally to a certain extent. On the whole, in the short term, urea companies have received shipment orders smoothly, and their quotations may continue to rise slightly; in the long run, as demand weakens and supply increases, the market may be suppressed and begin to decline.