- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

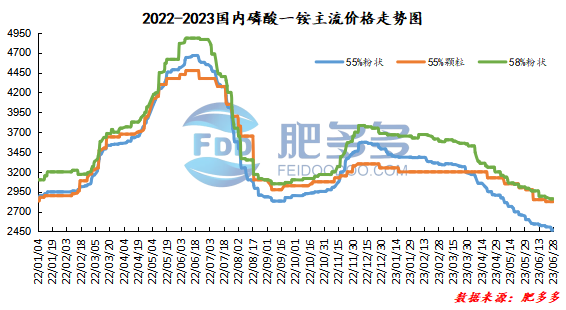

Monoammonium phosphate price index:

According to Feiduo data, on June 28, the 55% powder index of China's monoammonium phosphate was 2467.50, stable; the 55% particle index was 2825.00, stable; and the 58% powder index was 2860, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market remains weak and consolidated. The factory continues to implement the bottom-guarantee policy. The market price center of gravity has temporarily stabilized. It is reported that traders are receiving orders poorly. At present, there is slightly less demand for monoammonium for on-site topdressing or rice fertilization. The operating rate of the monoammonium industry is less than 40%. Most small and medium-sized enterprises continue to stop production, and large enterprises 'equipment is temporarily overhauled or reduced production. Cost support is weak, and there is still bearish sentiment in the market outlook due to the chaotic quotation of phosphate rock. Not only is China's demand weak, but international prices are also falling. Industry operators continue to be bearish on the market outlook and are mostly cautious in purchasing with a wait-and-see attitude. Overall, monoammonium phosphate will be weak and wait-and-see in the short term.

Specific market prices in each region are as follows:

Diammonium phosphate price index:

According to Feiduo data, on June 28, the 64% particle index of China's mainstream diammonium phosphate was 3,593.33, stable; the 60% brown index was 3,300.00, stable; and the 57% content index was 2620, stable.

Diammonium phosphate market analysis and forecast:

Today, China's diammonium phosphate market is in a stalemate, and some areas in the north have some demand for corn fertilizer, so a small amount of diammonium is taken on the market. Support at the raw material side is weak, the price of phosphate rock is unstable, the price of synthetic ammonia continues to decline, and the market mentality is bearish. Diammonium companies started at a low level, maintaining at around 50%. There is insufficient follow-up on China's new orders. The company's focus is currently on the shipment of export sources. Export data in May increased slightly compared with the previous period, but international prices are still falling, and the export market is not benefiting significantly. As diammonium enters the off-season of sales and the early application of fertilizer in autumn, the industry has a strong wait-and-see attitude towards the future market, waiting for the autumn fertilizer preparation market to turn around. Overall, it is expected that the diammonium market will consolidate in a weak manner in the short term.

Specific market prices in each region are as follows: