- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

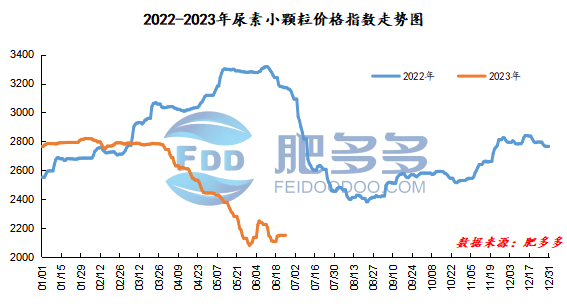

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on June 25 was 2,146.59, down 2.73 from the pre-holiday period and down 32.30% year-on-year.

Spot market analysis:

Today, China's urea spot market prices were partially lowered, mainly concentrated in North China, Northwest China and East China, with a reduction of 10-30 yuan/ton. Only in Guangxi, on-site supplies have tightened, and prices have been raised again by 60 yuan/ton in a short period of time. Downstream compound fertilizer start-up has declined, demand for urea has weakened, and local replenishment is operating in a differentiated manner. After the holiday, urea companies had low inventories and increased equipment failures, so positive supply supported today's market to remain firm. Specifically, prices in Northeast China have stabilized at 2,110 - 2,300 yuan/ton. Prices in North China fell to 1,880 - 2,160 yuan/ton. Prices in Northwest China fell to 2,090 - 2,100 yuan/ton. Prices in Southwest China have stabilized to 2,000 - 2,250 yuan/ton. Prices in East China fell to 2,080 - 2,160 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,050 - 2,350 yuan/ton, and the price of large particles has stabilized at 2,100 - 2,120 yuan/ton. Prices in South China rose to 2,230 - 2,290 yuan/ton.

Market outlook forecast:

Today, the futures market has not yet opened after the holiday, and futures need to continue to pay attention. A brief look at the fundamentals: on the supply side, some devices have short-term failures, local supply is tight, and the current situation of low inventory in the market is compounded by short-term positive supply to support the spot market; on the demand side, as the use of terminal fertilizers decreases, the start-up of compound fertilizers has dropped significantly. As a result, agricultural demand for urea has begun to weaken, and at the same time, due to the equally poor performance of the real estate industry, demand for upstream industries has been dragged down. Overall, the spot market showed a downward trend again after experiencing a brief surge in the previous period. However, in mid-July or the peak fertilizer season in the north, the urea market may have a phased upward adjustment before this.