- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

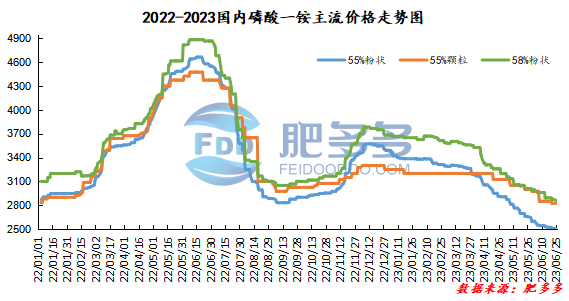

Monoammonium phosphate price index:

According to Feiduo data, on June 25, the 55% powder index of China's monoammonium phosphate was 2,501.88, down; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2860, down.

Monoammonium phosphate market analysis and forecast:

On the first day after the holiday, the price center of China's monoammonium phosphate market fell within a narrow range. Among them, the price of 58 powder in Shandong was lowered to 2,800 - 2,900 yuan/ton, and the price of 55 powder in Hubei was lowered to 2,350 - 2,450 yuan/ton. At present, the operating rate of the monoammonium industry is less than 40%. Most small and medium-sized enterprises continue to stop production and have no restart plans. In the off-season of sales in the ammonium monoamine industry, there are sporadic downstream purchases. Prices have temporarily stabilized during the cost end, but there is still bearish sentiment in the market outlook. Overall, monoammonium phosphate maintained a steady decline in the short term.

Specific market prices in each region are as follows:

Diammonium phosphate price index:

According to Feiduo data, on June 25, the 64% particle index of China's mainstream diammonium phosphate was 3,603.33, stable; the 60% brown index was 3,300.00, stable; and the 57% content index was 2625, stable.

Diammonium phosphate market analysis and forecast:

After the holiday, China's diammonium phosphate market was in a stalemate. On the raw material side, the phosphate rock market has temporarily stabilized, but there is still bearish sentiment. The synthetic ammonia and sulfur markets are deadlocked during the festival, and cost support is negative. During the week, construction of diammonium companies increased slightly, but as this wave of concentrated fertilizer use dissipated, downstream demand weakened. The Chinese market for diammonium has gradually entered the off-season for sales, and the company's sales focus has gradually shifted to the export market. In May, the volume of diammonium exports increased, and its performance this month may remain stable. Overall, the short-term diammonium market is mainly weak and stable.

Specific market prices in each region are as follows: