- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

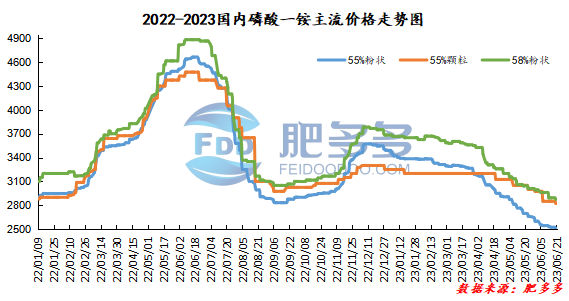

Monoammonium phosphate price index:

According to Feiduo data, on June 21, the 55% powder index of China's monoammonium phosphate was 2,508.13, stable; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,876.67, stable.

Monoammonium phosphate market analysis and forecast:

Today, the price center of China's monoammonium phosphate market is stable, and the market continues to operate in a weak position. Due to the sluggish downstream demand, the factory's pre-holiday order collection situation is unclear. On the raw material side, the mainstream price of synthetic ammonia is mixed. The sulfur market price has temporarily stabilized today after falling yesterday, and the cost support of monoammonium is getting worse. The supply and demand situation is still based on early judgment. The industry started at a low level, the inventory of some factories that had stopped production was consumed in the early stage, the inventory pressure of the factories decreased, and sporadic downstream purchases were made, and there was no willingness to hoard goods at any time. Based on the above judgments, it is expected that the monoammonium market will operate weakly and stably in the short term.

Specific market prices in each region are as follows:

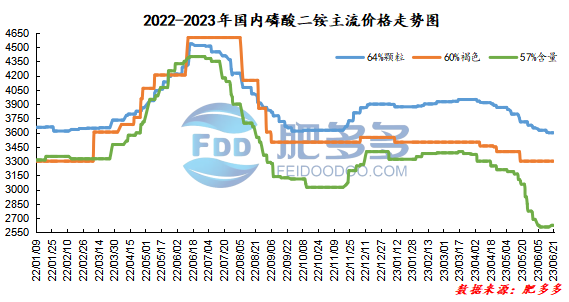

Diammonium phosphate price index:

According to Feiduo data, on June 21, the 64% particle index of China's mainstream diammonium phosphate was 3,603.33, stable; the 60% brown index was 3,300.00, stable; and the 57% content index was 2625, stable.

Diammonium phosphate market analysis and forecast:

Today, China's diammonium phosphate market continues to consolidate and remain in a stalemate. On the raw material side, the phosphate rock market has temporarily stabilized, but there is still bearish sentiment. The synthetic ammonia and sulfur markets are in a poor trend, and the continued decline in cost support is also exacerbating the bearish mentality of the industry. With the end of the previous wave of concentrated downstream demand, the diammonium market has once again entered a stalemate stage. Industry starts may decline after experiencing a narrow increase. Supply and demand in the Chinese market for diammonium are both weak, which is still within expectations during the off-season sales. In terms of exports, Bangladesh's planned bidding volume for diammonium has decreased compared with the same period in previous years. The boost to international demand has been limited. Transaction prices have moved closer. The export market has performed generally. In the future, it is necessary to continue to pay attention to the actual bidding volume. Overall, the short-term diammonium market is mainly weak and stable.

Specific market prices in each region are as follows: