- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

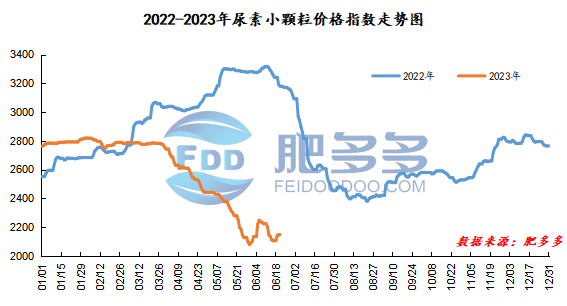

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on June 21 was 2,149.32, which was the same as yesterday, down 32.41% year-on-year.

Urea futures market:

The Urea UR2309 contract was running at a low overall level today. Immediately after the opening of early trading, it fell to the intraday low of 1680, and then the futures price fluctuated to the intraday high of 1719. In the afternoon, futures prices continued to fluctuate, closing at 1707 in late trading. The opening price of the Urea UR2309 contract: 1705, the highest price: 1719, the lowest price: 1680, the settlement price: 1702, the closing price: 1707. The closing price dropped 13, or 0.76% compared with the settlement price of the previous trading day. The daily fluctuation range is 1680-1719, and the spread is 39; The 09 contract has reduced its position by 13803 lots today, and has held 418715 lots so far.

Spot market analysis:

There was no significant fluctuation in China's urea spot market prices today, with only Liaoning and Jiangsu regions adjusting quotations sporadically. In terms of agricultural demand, centralized replenishment is gradually coming to an end, and there may be passive orders in North China, but most of them are small orders sold, and the operators are cautious. In terms of labor demand, due to the early holiday of some factories during the Dragon Boat Festival holiday, the industry's start-up performance is average, so labor demand is limited. Specifically, the price in Northeast China is 2,110 - 2,300 yuan/ton. Prices in North China have stabilized at 1,910 - 2,160 yuan/ton. Prices in the northwest region are stable at 2,110 - 2,120 yuan/ton. Prices in Southwest China have stabilized to 2,000 - 2,250 yuan/ton. Prices in East China have stabilized at 2,080 - 2,180 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,050 - 2,350 yuan/ton, and the price of large particles has stabilized at 2,100 - 2,120 yuan/ton. Prices in South China are stable at 2,200 - 2,280 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices fell within a narrow range today, and the two markets are driving each other's negative sentiment. Fundamentally speaking, Nissan remains at a high level of around 170,000 tons. Demand in the early stage is prominent, coupled with unstable price fluctuations, so most companies maintain low inventory and have obvious destocking. However, with the end of this wave of fertilization and topdressing, concentrated demand gradually disappeared, and most downstream factories were mainly in need of procurement. Over time, the contradiction of oversupply in the market will become prominent again. In the long run, only part of agricultural demand may appear in late July, but the off-season of urea demand is approaching, bad news in the market is fermentation, and low costs are under obvious pressure. In the long run, urea spot operations are mainly weak, and in the short term, a stalemate will remain.