- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

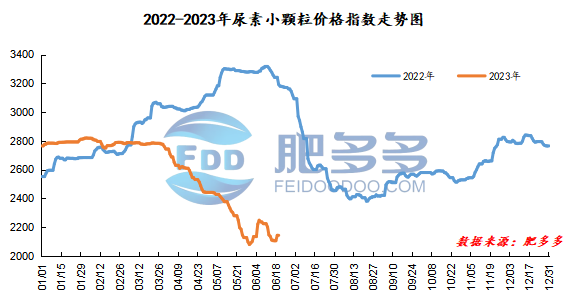

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 20 was 2,149.32, up 5.45 from yesterday, up 0.25% month-on-month, and down 32.66% year-on-year.

Urea futures market:

The Urea UR2309 contract opened in early trading today, and then fell to the lowest point of 1706. The price fluctuated mainly. In the afternoon, futures prices continued to fluctuate, closing at 1714 in late trading. The opening price of the Urea UR2309 contract: 1725, the highest price: 1737, the lowest price: 1706, the settlement price: 1720, and the closing price: 1714. Compared with the settlement price of the previous trading day, the closing price dropped by 27, or 1.55%. The fluctuation range throughout the day is 1706-1737, and the spread is 31; The 09 contract has increased its position by 12048 lots today, and has held 432518 lots so far.

Spot market analysis:

Today, most of China's urea spot market prices fluctuated upward in a narrow range. Shanxi and Hubei regions have sufficient on-site supply and average demand performance, so prices have been lowered within a narrow range. The trading of new orders in the market is regionally reflected, but it is duller than in the previous period. Therefore, the quotations of most companies are stable, the peak of agricultural demand has passed, downstream procurement has slowed down, and labor demand has been relatively weakened. Therefore, the urea spot market has once again corrected. Specifically, prices in Northeast China rose to 2,130 - 2,300 yuan/ton. Prices in North China range from 1,910 to 2,160 yuan/ton. Prices in the northwest region are stable at 2,110 - 2,120 yuan/ton. Prices in Southwest China have stabilized to 2,000 - 2,250 yuan/ton. Prices in East China rose to 2,080 - 2,180 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,050 - 2,350 yuan/ton, and the price of large particles has stabilized at 2,100 - 2,120 yuan/ton. Prices in South China rose to 2,200 - 2,280 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures price trend is relatively weak, but futures have generally strengthened in the near future and are differentiated from the spot trend. The gradual weakening of the spot market is due to the continuous improvement of supply and the continuous weakening of demand. Fundamentally speaking, pressure on the supply side continues, and the daily output remains above 170,000 tons. Due to the instability of the spot market during this period, grassroots agricultural supplies companies no longer have large inventories, so there is not much pressure on market inventories, and the downstream is in a state of active digestion. Once there is demand, they will collect goods in a short period of time. However, with the end of this wave of fertilization and topdressing, concentrated demand gradually disappeared, and most of them were mainly in need of procurement. In the long run, agricultural demand may still partially appear after July. In terms of cost, port coal remains low, but costs are still under pressure. On the whole, the current spot market sentiment is general. In the short term, prices may continue to rise within a narrow range, and in the long term, the market may fluctuate repeatedly as demand changes.