- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

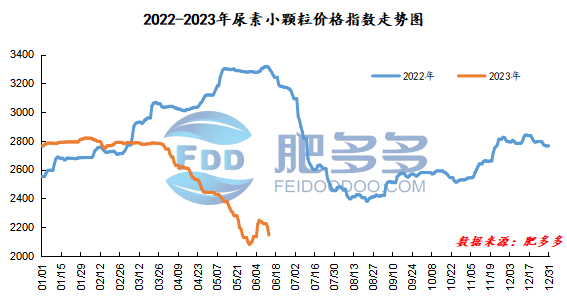

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 13 was 2,146.59, down 55.45 from yesterday, down 2.52% month-on-month, and down 35.08% year-on-year.

Urea futures market:

The price of the urea UR2309 contract continued to rise in a narrow range today. After the opening of early trading, the futures price reached its lowest point in the session, and then fluctuated upward. In the afternoon, the trend of the futures price remained unchanged. It rose to the intraday high of 1675 in the late session, and then fell slightly, closing at 1666 in the late session. The opening price of the Urea UR2309 contract: 1624, the highest price: 1675, the lowest price: 1621, the settlement price: 1650, the closing price: 1666. The closing price increased by 17, or 1.03% compared with the settlement price of the previous trading day. The daily fluctuation range is 1621-1675, and the spread is 54; The 09 contract has reduced its position by 11991 lots today, and has held 441919 lots so far.

Spot market analysis:

Today, China's urea spot market prices showed an overall decline, with quotes in mainstream regions falling by 10-160 yuan/ton. At present, most of the country's wheat harvest has been completed, topdressing is coming to an end, and agriculture has temporarily entered a blank period. It is difficult to support the previous rise in industrial demand alone, and prices have followed the trend downward. Specifically, prices in Northeast China fell to 2,080 - 2,260 yuan/ton. Prices in North China fell to 1,900 - 2,200 yuan/ton. Prices in Northwest China fell to 2,160 - 2,170 yuan/ton. Prices in Southwest China are stable at 2,000 - 2,450 yuan/ton. Prices in East China fell to 2,080 - 2,200 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,000 - 2,380 yuan/ton, and the price of large particles fell to 2,250 - 2,370 yuan/ton. Prices in South China are stable at 2,150 - 2,230 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures prices rebounded slightly compared with yesterday, but the market has no obvious driving force and will continue to fluctuate at low levels in the short term, which will have no positive impact on the spot market. Fundamentally speaking, first of all, the pressure on the supply side is still high. In the past few days, when the demand for hoarding surged, the pressure has not been significant. However, as urea production capacity is increased in the later period and the demand for hoarding decreases, the pressure on urea supply is bound to form a constraint on the market. Secondly, looking at the demand side, the demand for high nitrogen fertilizer production is coming to an end, and demand support is gradually decreasing in the early stage. In terms of cost, port coal

Maintaining low prices requires insufficient cost support. On the export side, the appearance of printed marks depressed China's urea price, but it was only slightly positive for the Chinese urea market in terms of emotion. On the whole, the positive factors in the urea spot market are gradually weakening, and the price center of gravity will continue to fall in the later period.