- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

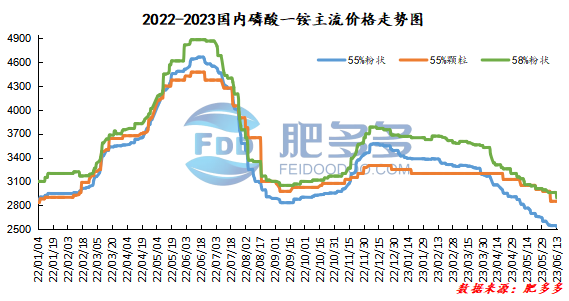

Monoammonium phosphate price index:

According to Feiduo data, on June 13, the 55% powder index of China's monoammonium phosphate was 2,531.25, down; the 55% particle index was 2,850.00, stable; and the 58% powder index was 2,893.33, down.

Monoammonium phosphate market analysis and forecast:

Today, the market price center of gravity of monoammonium phosphate in China has dropped. The main reason is that the price of 55% powder in Yunnan has been lowered by 100 yuan/ton to 2,200 - 2,300 yuan/ton, and the price of 58% powder has been lowered by 300 yuan/ton to 2,400 - 2,600 yuan/ton. Local factories have insufficient follow-up on new orders, and prices in other provinces are low. Affected by low demand and prices, the operating load of factory equipment fell within a narrow range again. The raw material-side synthetic ammonia market is operating in a weak position, sulfur prices are falling, phosphorus rock prices are temporarily stable, and cost support remains weak. The situation on the demand side is the same as yesterday. Summer fertilization is over and autumn fertilization is still early, which will undoubtedly add to the deterioration in the monoammonium market, which is already in the off-season. In the short term, it is expected that the monoammonium market will continue to be weak and downward. nbsp;

Specific market prices in each region are as follows:

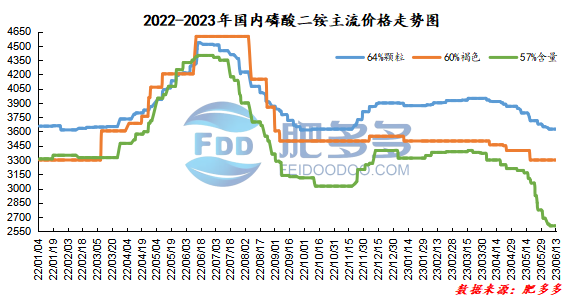

Diammonium phosphate price index:

According to Feiduo data, on June 13, the 64% particle index of China's mainstream diammonium phosphate was 3,625.00, stable; the 60% brown index was 3,300.00, stable; and the 57% content index was 2,607.50, stable.

Diammonium phosphate market analysis and forecast:

Recently, China's diammonium phosphate market has continued to operate stably, and the price center of gravity has not fluctuated significantly. Last week, the demand for corn manure was closely followed, so the factory had considerable new orders sold. Currently, the factory relies on advance orders to stabilize production. Although some orders are advancing, the industry still has a bearish attitude towards the market outlook. The main reason is that demand for corn fertilizer is coming to an end, market trading is slack, and fertilization in autumn is still early. There are still no positive factors in terms of exports. Overall, the diammonium market will operate more stably in the short term.

Specific market prices in each region are as follows: